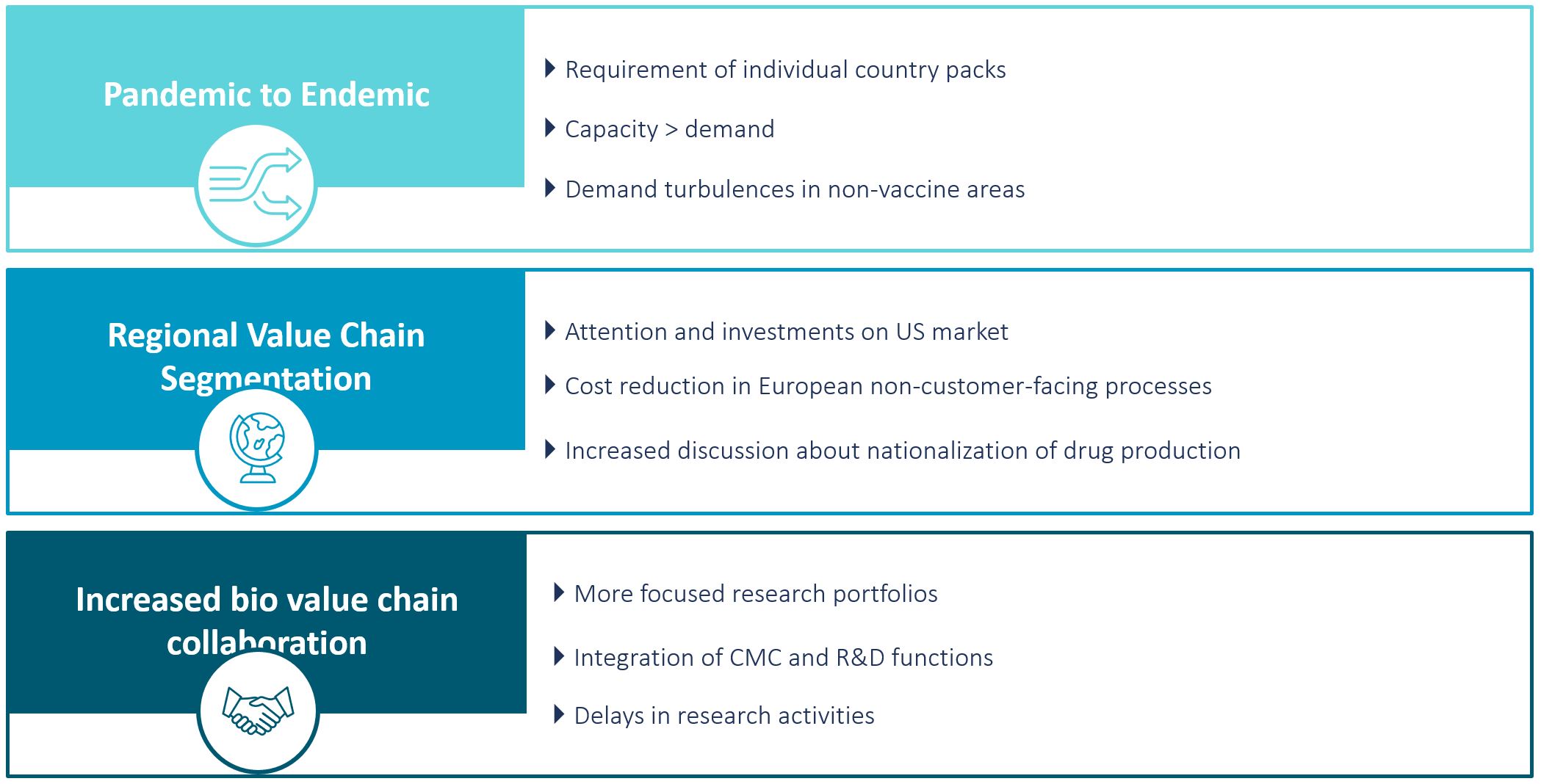

During the last two years, pharma value chains have received attention either through tremendous performance in developing, making, and distributing new drugs throughout Covid-19, but also because of drug shortages noticed in Europe. In 2023, we will see continuous attention on pharma value chains and three trends shaping them.

- Covid-19 is expected to move from pandemic to endemic mode, which will change the value chains built around it end-to-end. Some of the biggest impacts are:

- Finished goods/vials which are, with few exceptions, globally deliverable will need to be replaced by dedicated country packs fulfilling regulatory compliance.

- During pandemic mode, increasing and utilizing production capacity was the highest priority. If one customer canceled an order, the capacity got allocated to others. In 2023, capacity will exceed demand. Thus, production planning must be much closer synchronized with individual country demands.

- The consequences of Covid-19 for the population immunity system will invoke demand turbulences in non-vaccine areas. Late 2022 already showed drug shortages for pediatric patients e.g., of liquid formulations, antibiotics and even painkillers, caused by an unprecedented number of children being affected by a combination of flu, RSV, and Covid-19. Even without supply issues such peaks lead to bottlenecks. When we add the current conditions of global value chains it becomes a serious risk to patients.

2. Value chains will be stronger segmented by region.

- PharmaCos will increase their focus and investments in the US market to enhance patient treatment and satisfaction. The reason for this is that the absolute US pharma market growth will outperform any other region worldwide. New drugs are generally introduced in the US first due to higher reimbursement prices and the large market size.

- In Europe, the attention is more on costs with a high share of generics and extensive price pressure through parallel trade. For value chains we therefore expect non-customer-facing processes to be reviewed and eliminated, automated, or off-shored.

- The discussion about nationalization of manufacturing for critical drugs as well as increasing transparency of potential drug shortages will grow due to more severe supply chain issues which are caused by complex offshore production with 60-80% of drug substance made in China and India and drug products distributed across all regions.

- Bio value chains will see closer cost attention and increased collaboration.

- The increase in interest rates will require a more focused research portfolio to reduce the risk of failure.

- There will be closer integration of functions between R&D and CMC. Traditionally in chemical pharma value chains, CMC got involved when certain gates were met e.g., involvement in lead optimization and handover for stage 1 clinical trials. In biological value chains, we expect analytical development and process development (from CMC) to be involved much earlier, forming cross-functional teams with research to be more agile. That means the classical functional organigram will be diminished and substituted by an end-to-end setup by modality.

- Delays in research activities will increase. PharmaCos have a lack of internal talents and resources in R&D functions (including CMC) for complex technologies such as Cell & Gene or oligonucleotide therapies. This will force them to engage and collaborate with external CROs and CDMO/CMOs even stronger. Already now there are delays in research activities due to high demand, meaning that delays will continue to increase.

Overall, the three trends will continue to draw high attention on pharma value chains in 2023. Do you agree? What are your thoughts and perceptions for the new year?