The digital transformation of order-to-cash is currently on the agenda of many companies as is promises many benefits. But how can these benefits be realized? Which technology can be implemented for which order-to-cash process step?

As outlined in our prior article detailing the business case, companies can benefit from mature order-to-cash processes with increased profit, a more stable cash flow and increased customer satisfaction. In this context, the automation of processes is essential to increase the maturity of the end-to-end process, and to be quick and efficient. Therefore, technological solutions such as Robotic Process Automation (RPA), Artificial Intelligence (AI) and Machine Learning (ML) are introduced.

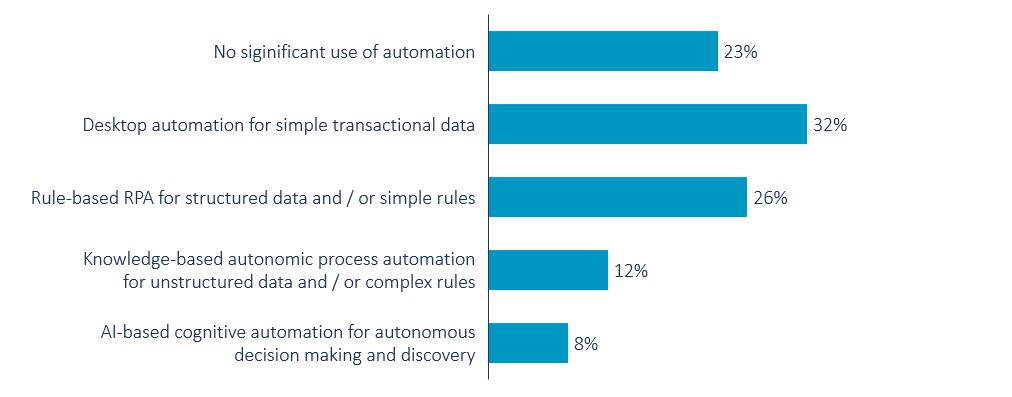

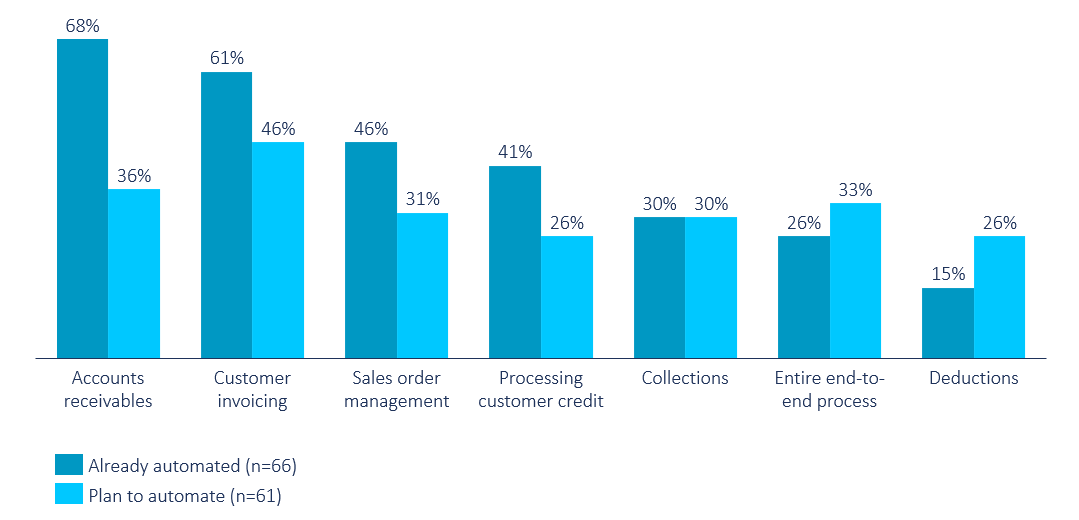

A recent study revealed big differences in the order-to-cash digitalization maturity across companies. While 23 percent do not use automation, 8 percent state that they apply advanced AI-based cognitive automation. Thereby, already 67 percent apply RPA while only 51 percent use AI.[1] The study revealed that most companies have automated accounts receivables (68%), customer invoicing (61%) and sales order management (46%). Only 26 percent have automated their end-to-end order-to-cash process and 33 percent plan to do so.[2] Figures 1 and 2 show the results of the studies in detail.

Digital Transformation of Order-to-Cash – Why and How?

Experienced benefits of transforming order-to-cash are increased productivity and efficiency. Shortened cycle times and less errors add up to even more benefits. Additionally, employees are freed from repetitive and monotonous tasks.

The digital transformation of order-to-cash includes a wide range of automation possibilities. Often, RPA software forms the basis. Transactions and non-routine tasks can be automated thanks to enhancement by AI. Also, decisions with self-learning bots are optimized. Applying process mining additionally optimizes order-to-cash. More advanced companies introduce smart contracts based on the blockchain technology. As self-contained programs, they are able to fulfil the contractual obligations when the required conditions are met.

Implementing Digital Solutions in Every Process Step

Digital solutions for order-to-cash can be applied in each process step. Before implementing them, we first perform an assessment. There, we calculate the business case of the individual solutions at the specific process steps. Based on this, we develop a roadmap for the digital transformation of the order to cash process. Figure 3 summarizes the digitalization highlights of each process step from master data to post-fulfilment management before they are explained in detail.

Prerequisite: Master data

Correct and up-to date master data forms the basis for digital order-to-cash processes. Maintenance of master data can be supported by RPA, e.g., by updating customer master data across all systems or adjusting prices based on market behaviors.

More advanced companies save their master data on a private blockchain. Updates are shared with all parties in real time which minimizes manual work and prevents inconsistent data. Additionally, if a commercial agreement is based on a smart contract, it can automatically request the customer to update master data or to share required certifications. Thereby, all involved parties have transparency about the progress of transactions.

Customer and commercials management

Discussing and aligning on adjusted commercial agreements can be a lengthy process. By implementing a chatbot, commercial terms renegotiation can be performed with less human effort. Credit management can be simplified by integrating with credit rating providers to receive information for customer risk and credit assessments. Additionally, companies can apply AI-based behavioral credit scoring and algorithmic data credit trend analysis.

Order receipt and confirmation

There are many possible applications to digitalize steps during the order receipt and confirmation process to improve order-to-cash. Starting with the quotation process, a bot can create customer profiles from business reports, social media platforms, news sites and other publicly accessible sites. This collected information can be used to automatically recommend additional products and services. More advanced companies introduce smart contracts containing information relevant for purchases such as product, delivery date and payment terms.

RPA also offers many opportunities to automate sales order management. Orders placed online can be automatically integrated, and orders from paper and emails can be automatically created within in the ERP system. It verifies correctness and flags exceptions for review.

After the order entry, the credit limit can be checked applying AI or ML. Based on all available data, the credit is approved or rejected. Saving key data elements as the order and contractual agreement on the blockchain increases efficiency. For example, a customer can be automatically notified if he places an order and his credit limit is already reached.

Next, regulatory and availability checks are performed automatically in the system. For this, the availability check is based on company-wide real-time data and considers business priorities and profitability.

As a final step, the order is automatically routed and matched in CRM and ERP systems and the customer receives an order confirmation. In case of order changes, the customer is automatically informed. Additionally, he can track the status of his order in the web portal.

Order fulfillment

For a digitally supported order fulfillment, the delivery can be created automatically between order confirmation and transport dispositioning date. Afterwards, an automated and punctual dispatch is assured. For this purpose, processing is in line with the confirmed delivery date and on time, in full performance is monitored. An automatic order shipment confirmation can be sent via RPA.

Invoicing and receivables management

After the order is routed and matched in CRM and ERP systems, the bill generation is triggered. The bill is automatically calculated (including relevant discounts), verified and delivered. If smart contracts are used, this assures a correct creation of receivables. They prevent reviewing and resolving pricing and invoicing conflicts. The smart contract can be coded to automatically settle the invoice after the invoice has been approved by the finance department and accepted by the customer.

Within accounts receivables, physical payments are first scanned using optical character recognition. Next, the order-to-billing conciliation is performed with RPA or AI. More advanced companies additionally apply AI to perform sanity checks and cash pooling. To create more transparency, blockchain technology can be used. For example, it can be monitored when a customer has released a payment. This information is not only helpful for accounts receivables, but also supports the collections process and provides real-time credit risk information.

The collection process can be digitalized to various degrees. It can either be supported by a bot which executes the dunning. The bot sends the dunning reports to the account managers, who then directly contact the customer. If direct contact is not necessary, dunning letters can be sent directly to the customer. More advanced companies can also use AI to conduct further analysis as revenue leakage.

Post fulfillment management

AI offers the most suitable way to digitize dispute management. For standard cases, AI identifies deductions with a high probability of being valid and automatically resolves them. It flags exceptions for manual intervention. Additionally, ML for problem clustering and customer trends analysis can support the post fulfillment management.

Outlook

Digital order-to-cash processes– this term includes many chances along the end-to-end process. Before starting the journey, it needs an alignment on a companywide digital roadmap to assure cross-functional commitment. Here the desired degree of digitalization across all functions needs to be stated, for example, whether the focus should be on implementing RPA solutions or managing the order-to-cash process with smart contracts.

The digital transformation of the order-to-cash process is essential in today’s world. With less qualified personnel available, it is imperative to find new ways to handle the process. While the employees can focus on high-quality customer service, other activities can be automated. As a result, the customers will value the quick, efficient, and transparent process with human interaction where required. In the long term, this will positively effect profit.

__________

Transforming the order-to-cash process can lead to a stable cash flow and better response time towards customers, adding to a good customer experience. Still, the process has been neglected in many companies. Our blogs series shows the benefits of investing into order-to-cash processes.

- Introduction: STEPS TO IMPROVE ORDER-TO-CASH PROCESS

- Business case: EXPERIENCED BENEFITS OF ORDER-TO-CASH PROJECTS

- Digital order-to-cash: IMPLEMENTING DIGITAL SOLUTIONS IN EVERY PROCESS STEP

__________

[1] SCM Order to Cash (apqc.org)

[2] K011140_SCM_Automating O2C.pdf (apqc.org)

We would like to thank Miriam Prein for her valuable contribution to this article.