The COVID-19 pandemic presents a major challenge to the often inefficient value chains of the biotech industry. In a short series of articles, we explore how biotech companies can improve efficiency, sustainability and resilience through designing an innovative value chain model.

Designing the operating model for biotech value chains

The COVID-19 pandemic presents a challenge not only for populations and healthcare systems but also for value chains, especially those of pharmaceutical companies. On the one hand, shortages of human resources and materials emerge, as well as the established infrastructure reveals its weak spots. On the other hand, demand for critical pharmaceutical and medical device products increases tremendously. Especially the mostly still infant biotech companies have to rethink and upgrade their value chain strategies and approaches to optimization and risk management. Biotechs need an innovative value chain model that helps them better plan in strategic scenarios, put risk and reliability at the center, and effectively manage external partner networks.

Biotech is transforming the life science market

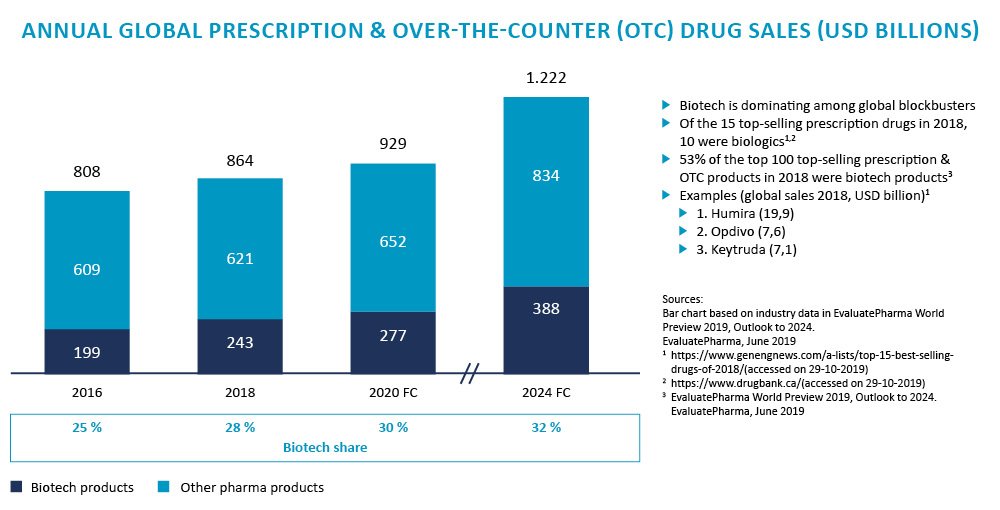

Over the last decade, pharmaceutical value chains have moved from being dominated by small molecule drugs, mainly produced in large batches by chemical synthesis, to seeing an increasing presence of biological medicines, produced using living organisms and cells. These biologics are not only present in clinical pipelines but are also dominating growth in the commercial market.

What started gradually is nothing short of a full-scale transformation of the innovative drugs business, which can be proven by the numbers: The global share in sales of biotech products for the entire global pharma market has steadily grown between 2010 and 2018, starting from 18% in 2010 and rising to 28% in 2018, and is projected to further increase to approx. 32% by 2024.[1]

Figure 1: Biotech is transforming the life science market: key facts and figures

Figure 1: Biotech is transforming the life science market: key facts and figures

The rise of biologics is not a phenomenon that can only be observed in the United States or Europe – clinical research and commercialization in this area have been rapidly accelerating globally. Biopharmaceutical sales in China, for example, have grown from USD 9.4 billion to USD 22.8 billion between 2012 and 2016 (nearly 25% p.a.), and the market is estimated to continue to grow at this rate so that by 2021 sales volume is expected to reach USD 48.8 billion[2]. Furthermore, it has built one of the largest pipelines globally in cutting-edge areas such as modern cell and gene therapy.[3]

Biological drugs are continuously evolving and far from being a homogeneous group. At first, companies started launching so-called first-generation biologics, mainly recombinant proteins and vaccines. These were then followed by modern biologics (mainly antibodies and mAbs) and cell and gene therapies, i.e., highly personalized therapies made from a patient’s cells or donor material. This article will focus on modern biologics, with some reference to personalized treatments. In the next article, we will take a closer look at specific challenges facing cell and gene therapies and some potential solutions.

Biotech value chains pose unique challenges

Let us zoom in on the value chain for modern biologics companies (depicted in figure 2), covering the end-to-end flow from discovery to sales and patient care. It consists of five main phases and several overarching / supporting activities.

Figure 2: Simplified value chain model for modern biologics

Figure 2: Simplified value chain model for modern biologics

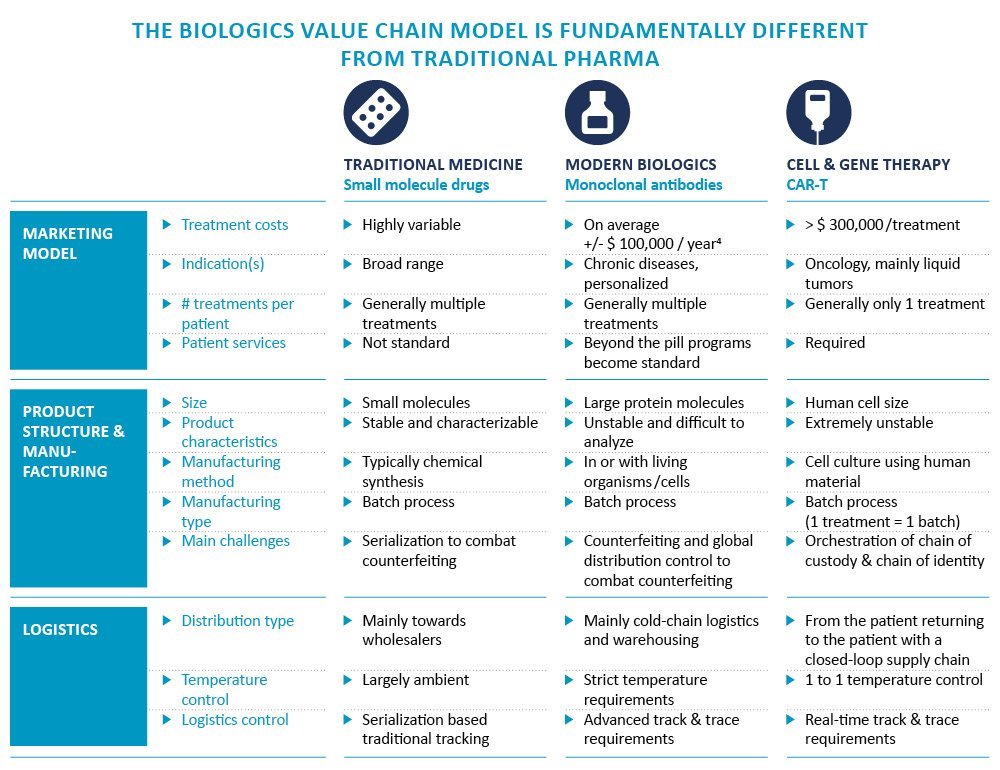

From this bird’s-eye view, it may seem that pharmaceutical and biotech value chains are very similar. Under the surface, however, modern biologics and cell and gene therapy value chains are often fundamentally different from those of the traditional pharma world. Figure 3 below shows the biggest areas of difference between traditional medicine, modern biologics, and cell and gene therapy.

While biologics are irreversibly changing the face of the industry, they are also faced with some unique challenges for their value chains, which put their business model under increasing stress and present it with higher risks. In particular, we see the following challenges that need to be addressed:

- Need for major capital investments under high demand uncertainty

- More variable and unreliable processes requiring excellent risk management

- Asset-light value chains with a complex ecosystem of external partners and a range of very diverse, innovative partnering approaches

- Significant quality challenges, which are often linked with external supplier performance

- Need for constant launch and transformation from a science-driven environment to seamless integration of science and commercial supply

Figure 3: Main characteristics of 3 pharmaceutical product types: Traditional medicine, modern biologics, and cell & gene therapies[4]

Figure 3: Main characteristics of 3 pharmaceutical product types: Traditional medicine, modern biologics, and cell & gene therapies[4]

But how to best design and manage the biotech value chain to address these unique challenges effectively?

Biotech companies need a new value chain operating model

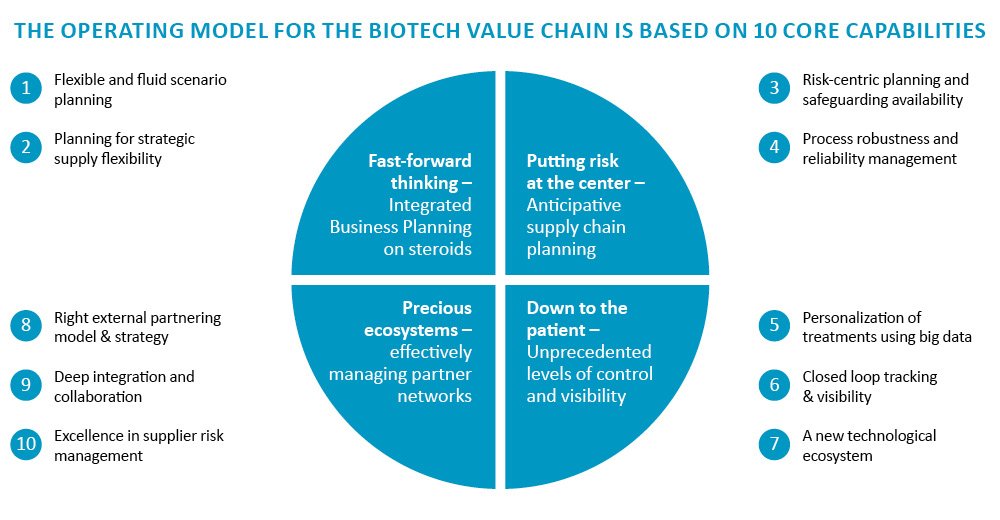

By now, it should be clear that the traditional pharma operating model is not a good match for biotech companies. Instead, they require fundamentally different core processes, capabilities, and solutions. Based on our experience, ten capabilities split across four dimensions are critical for biotech companies to exploit the full potential of their value chains:

Figure 4: Core value chain capabilities specifically for biotech players

Figure 4: Core value chain capabilities specifically for biotech players

In our next blog post, we will explore each of these dimensions and capabilities in detail. In the meantime, we invite our readers from biotech companies to participate in our current executive survey on biotech value chains. We appreciate your contribution to our research!

We would like to thank Camila Mendes and Marco Gorgas for their valuable contribution to this article.

Part II: COVID-19: the stress test for biotech value chains

References:

[1] EvaluatePharma World Preview 2019, Outlook to 2024. EvaluatePharma, June 2019

[2] Vicky Xia. Robust growth for China’s Biopharma market. Cphi.com 2018. Accessed through: https://www.cphi.com/europe/visit/news-and-updates/pharma-outlook-12-trends-watch-2019

[3] Jia Xin Yu, Vanessa M. Hubbard-Lucey, Jun Tang. The global pipeline of cell therapies for cancer. Nat Rev Drug Discov. 2019 Oct;18(11):821-822. Accessed through: https://www.nature.com/articles/d41573-019-00090-z on 08.11.2019

[4] Inmaculada Hernandez, Samuel W. Bott, Anish S. Patel, Collin G. Wolf, Alexa R. Hospodar, Shivani Sampathkumar, William H. Shrank. Pricing of Monoclonal Antibody Therapies: Higher If Used for Cancer? Am J Manag Care. 2018;24(2):109-112. Accessed through: https://www.ajmc.com/journals/issue/2018/2018-vol24-n2/pricing-of-monoclonal-antibody-therapies-higher-if-used-for-cancer on 08.11.2019