Companies are facing a dilemma with regards to inventory and working capital management. On the one hand, an environment with ongoing global disruptions, volatile demand and unreliable supply requires more inventory as buffer. On the other hand, the inflation and a weak economy put an immense pressure on companies towards leaner inventories. In the second article of the series, we are completing the picture how modern inventory management can cope with these challenges.

A new inventory management approach needs to evolve different dimensions in an organization. In our previous article we laid out how to apply a data-driven and more proactive stock parametrization logic, with continuous screening of the environment, and continuous adjustment of targets levels. We also emphasized how risk stocks – which often have been defined in a more rule-of-thumb or judgement-based way – need to be optimized based on data & analytics.

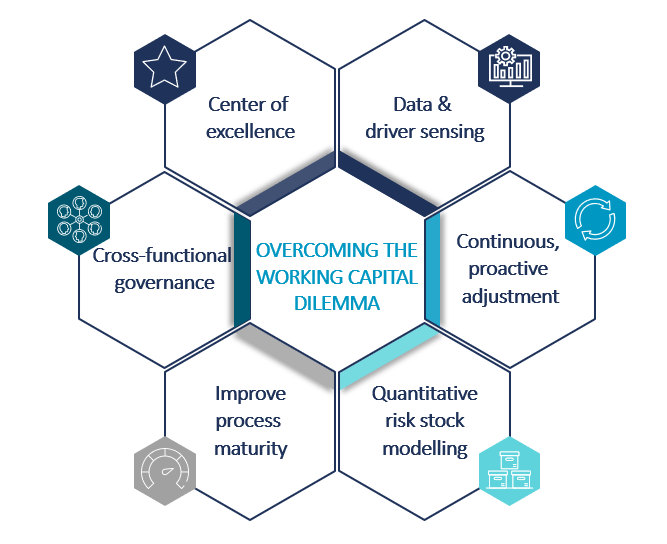

Figure 1 displays three further pillars, we are seeing as key principles of modern inventory management:

- The proactive management and improvement of the underlying drivers of inventories, such as demand variability or manufacturing lead time.

- The integration of inventory management into overall processes and governance, e.g. with financial and budget planning

- The establishment of a center of excellence that bundles the advanced capabilities for E2E inventory management in one central unit.

In the following chapters, we are explaining these further pillars.

Improve Process Maturity

Improving process maturity is the lever to structurally improve working capital despite a more volatile and uncertain supply and demand environment. Under given external conditions, the best level of inventory reflects the maturity of supply chain design and operations, like for example lead times, manufacturing & order frequencies, internal variability, planning errors, and network flexibility (see drivers outlined above).

Only by addressing these levers as outlined in figure 2, companies will sustainably improve their working capital efficiency. Over-simplified, other changes are window-dressing at the expense of service level and cost performance. Consequently, the cost and inflationary pressure calls for continued efforts to structurally improve supply chain maturity.

To achieve this aim, a strong cross-functional collaboration is needed: experts from manufacturing, quality, sourcing, logistics, and planning need to work together to reduce cycles times and increase lead time reliability. Only an agile and reliable manufacturing set-up will allow taking out inventory buffers along the value chain, be it in raw materials, WIP, or finished goods.

As another example, minimizing internal variability and planning inaccuracy is key, as many stock levels are only covering a lack of strong planning and coordination. This can for example be seen when scheduling or production on a production line based on a tactical plan is not possible due to wrong assumptions on output per hour, OEE, or labor/ material availability. This immediately will lead to additional waiting times, and indirectly to suboptimal safety buffers of production to protect against planning errors.

Thus, supply chain management needs to effectively collaborate with all functions to increase overall process maturity, and improved inventory management will come as a result. Figure 4 shows the different inventory drivers and specific examples that result in an increase or decrease in stock.

Cross-Functional Governance

Inventory management can only work smoothly if it works closely integrated with other functions than supply chain management and embedded in cross-functional governance. Of special importance are the integration of supply chain management with finance, commercial, and manufacturing:

- With regards to Finance, two points of integration are critical and can often be improved. Firstly, better linking bottom-up inventory parametrization with the budgeting process: Supply Chain can better enable Finance by providing inventory scenarios which simulate the impact of different growth rates, portfolio developments, or risk strategies. In this way, the bottom-up (volume-driven) and top-down (value-driven) approach to budget planning can be better synchronized. Secondly, with an improved inventory & availability projection and simulation capability across the full portfolio, Supply Chain can provide better visibility into the monthly financial rolling forecasting process. A more forward-looking inventory planning and steering is of utmost importance, given the negative impact late target adjustments (e.g., the year-end push to reduce inventory levels) have on supply chain stability, cost, and customer service.

The integration of Supply Chain and Finance is everything but easy. Based on our experience, with the two steps described above, Supply Chain can make a good contribution to better aligning the volume and value perspective and stabilizing operations. - With regards to a strong Commercial integration, several points are critical. While Supply Chain should be responsible for inventory levels from raw materials to finished goods, a strong governance with the commercial regions and country affiliates is of high importance. Based on our experience, key elements of such a governance are: A transparent and open alignment of (finished goods) inventory targets proposed by Supply Chain and aligned with the local Commercial and Supply Chain Team; a systematic approach to define and update the segmentation of the portfolio (e.g., based on strategic importance and revenue of products); a transparent alignment of key changes in finished goods inventory policies as part of the country S&OP; and clear rules how forecast performance and a potential over-forecasting bias can impact the allocation of inventories.

As Supply Chain is responsible to optimally allocate inventories from a total company perspective, certain tough decisions impacting individual regions and countries can never be avoided – it is impossible to please everybody. Therefore, a transparent governance is needed, with clear standards and openness on rules for decision making. - Lastly, we want to highlight the integration with Manufacturing and External Supply. As we have outlined above, manufacturing lead times, reliability, and campaigning are a major driver for inventory optimization. We see four key areas where a stronger integration of Supply Chain with Manufacturing operations can add value: Firstly, a continuous joint monitoring of lead time, reliability, and adherence. Secondly, jointly defining and running a continuous, data-driven review of batch and campaign sizes, which balances availability, cost, utilization/ idle times, and capital impacts. Thirdly, a joint monitoring and continuous improvement of finished goods inventories to minimize early production, and waiting time in factory for testing, release, and shipping. And fourthly, clear responsibilities and processes for the parametrization and management of raw material and component stock levels. These have become very critical in current times of shortage but are sometimes managed more locally on factory level.

Strong inventory management is much more than just technicalities and formulas. As outlined above, a strong governance is needed which clearly delineates responsibilities, establishes transparent decision rules, and creates an open, collaborative environment between Supply Chain, Finance, Commercial, and Manufacturing.

Establishing a Center of Excellence

The high importance, cross-functional nature, and reliance on data & analytics make it clear that inventory configuration and parametrization should be far more important than ‘just another activity of supply planning’ in sites, DCs, or countries. Inventory parametrization must be data-driven, and companies need a strong center of excellence which applies a transparent methodology to continuously update and monitor inventory-related data along the supply chain, monitor stock target adherence to parameters, and adjust stock parameters.

This does not imply the centralization of inventory management decisions, but a modern 3-tier structure of decision support and decision making. As the 1st level, the center of excellence ensures a consistent methodology, rules, processes, data, and tools, plus runs the inventory analysis and re-parametrization. On the 2nd level, parameter adjustments are proposed to supply chain planners, which can calibrate the analytical results with deep understanding of the end-to-end value chain, supply situation, and market and portfolio knowledge for their area of responsibility. On the 3rd level, the supply chain planners align the appropriate parameter changes with the respective stakeholders, e.g., decision makers in manufacturing sites, distribution centers, and commercial regions and affiliates.

Thus, a center of excellence for inventory configuration and parametrization provides a consistent foundation in data & analytics, inventory simulation, and decision support for this highly critical supply chain topic.

The Way Forward

As we have outlined above, the current rather challenging environment calls for improving supply chain maturity, and professionalizing inventory management as sketched in this article is a key building block on that journey. Beyond reviewing and benchmarking the current inventory levels to identify steps for quick improvement, companies should also take a step back and review the six elements of modern inventory management to determine where more structural improvements are feasible to sustain better working capital efficiency in the long run. This can only be successful in a cross-company effort: with supply chain functions in the lead role, and with close involvement of production, commercial, and finance.

We would like to thank Florian Kreitz for his valuable contribution to this article.