2022 has seen the end of many certainties and continuities in supply chain management and business operations. Cracks in the system of global supply chains require systematic recalibration from strategic design to fast operational response. Beyond the buzzwords, CXOs need to focus on five imperatives to make their supply chains an asset rather than a liability for 2023 and beyond.

A Turbulent Year’s Rewind

In last year’s article “Linking People and Technology – Supply Chain Trends 2022+”, we already talked about a broader development towards a more chaotic environment. However, end of 2021 there was hope to leave the chaotic days of the pandemic behind and embark towards a calmer economic environment at least for a few years. As we all have experienced, new challenges very soon dashed this hope.

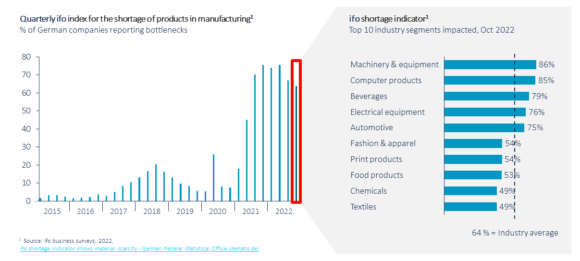

In retrospect, we three key underlying supply chain topics in 2022: shortage, disruptions, and rising costs. 2022 became the year of sustained, broad, and multi-sector shortages in global supply chains. While 2021 already saw material shortages in selected sectors such as semiconductors, wood, or plastics, we were still experiencing more singular events. In 2022, material shortages further solidified, broadened, and intensified with the energy crisis. They triggered many imbalances of demand and supply, which will continue to ripple through supply chains and cause further volatility in 2023. The material shortage index of the German ifo Institute shows very clearly the massive uplift of material shortages in 2021/22, impacting all critical industries (see table 1).

Sustained and broad material shortages have put many key industries under pressure, and a selection of top examples can be seen in table 2. The impact was not abstract but indeed very tangible for both business customers and consumers, and here we just want to mention a few examples out of many: In September 2022, automaker Ford announced that more than 40,000 cars (mainly large pickups and SUV) could not be delivered due to missing parts, with significant impact on quarterly earnings. The war in Ukraine has interrupted fertilizer supplies (nitrogen, ammonia), and forced many European fertilizer manufacturers to shut down production and scramble for new sources, leading to shortages and spiking prices across major markets.

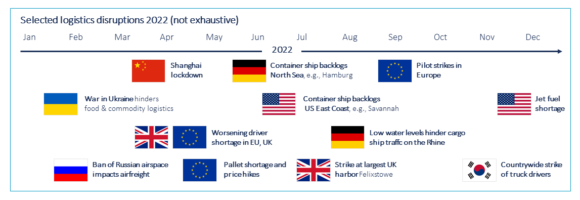

Following the trend of 2021, supply chain and logistics were challenged with many disruptions (see table 3 for selected examples). Labor shortages (e.g., truck drivers) worsened compared to last year in the EU and UK. Container handling backlogs in ports such as Savannah, Shanghai, and Hamburg led to major delays in supply chains and long queues of container ships on the seashore. The start of the war in Ukraine further interrupted logistics chains, and an exceptionally hot and dry summer led to additional ripple effects by severely constraining inland water transport on the Rhine. Logistics conditions continued to be vulnerable, and many of us experienced that “something somewhere is always broken”.

The shortage situation and energy crisis went along with an unparalleled increase in material prices. According to the German statistical bureau (Destatis), producer prices of industrial products in Germany increased in October 2022 by +35% compared to the same month in 2021: this includes examples like food (+25%), iron/steel/alloys (+21%), fertilizers & nitrogen (+113%), and newsprint paper (96%). These levels of year-on-year price increases are definitely not a cyclical phenomenon, but clear outliers since the start of measurement in the 1970ies. They indicate a major demand and supply crisis and re-adjustments in global supply chains.

Cracks in the System That Require Supply Chain Recalibration

The above-said indicates tectonic shifts in the environment of global supply chains, with regard to disruptive events, shortages, and price pressures. It is rational to structurally prepare the supply chain for such a “hyper-turbulent” environment rather than hope that the development will go away and revert to business-as-usual as we knew it in pre-pandemic times. Alone the threats we know – such as continued pandemics, wars, natural disasters, climate events, and growing political adversity – will drive further crises, let alone the “unknown unknowns” we do not even think of today.

Assuming we will face a continued “hyper-turbulent” environment, the question is: how are today’s supply chains prepared for 2023? How to respond to the major “cracks in the system” of global supply chains, and overcome an accelerating gap between an increasingly demanding, unforgiving environment, and the lagging capabilities in corporate supply chains with regard to networks, processes, governance, skills, and technology? Based on our work in many supply chain projects in 2022 across a diverse set of industries, we see five imperatives for supply chain recalibration that operations leaders should follow:

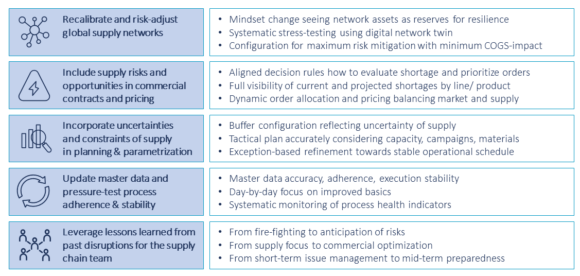

- Recalibrate and risk-adjust global supply networks, including internal and external manufacturing and sourcing.

- Include supply risks and opportunities in commercial contracts, pricing, and commitments to close the loop between supply chain and commercial and optimize for profit.

- Incorporate uncertainties and constraints of supply in planning and parametrization, as deterministic, unconstraint supply planning has proven inadequate for the current environment.

- Update master data, planning parameters, and pressure-test process stability, as the new environment does not forgive basic supply chain flaws.

- Leverage the lessons learned from past disruptions to enable associates to better manage the future and design more resilient supply chain processes and faster decision-making.

The Five Imperatives to Make Supply Chain an Asset

1. Recalibrate and risk-adjust global supply networks

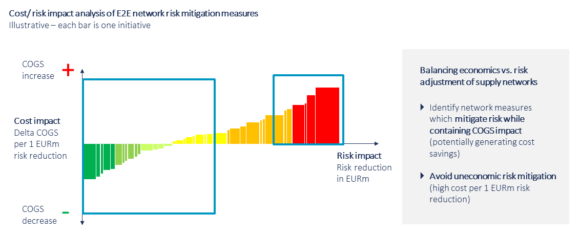

As the first imperative, global supply networks need to be risk-adjusted to increase structural preparedness for the hyper-turbulent environment. And here we are not primarily talking about the big strategic moves such as re-shoring, nearshoring, or de-coupling, which will continue to evolve in 2023 spurred by macro-level or political developments such as tensions in international relations or protective policies (US Inflation Reduction Act, and similar EU legislation to follow suit). The true risk adjustment of supply networks is unpolitical, gradual, and a matter of smart supply chain configuration. And it starts with an important mindset change: network assets (capacity, inventory, routes) need to be seen not only as drivers of cost, but also as important reserves for resilience which can reduce vulnerability against disruptive events. But network assets need to be configured in the right way to optimize the resilience of the end-to-end network, answering questions like: Where to allocate backup capacities in the network to best protect the business? For which materials does dual- or multi-sourcing most reduce vulnerability? Which additional shipping routes should be introduced to best diversify the exposure to disruptions? Only by optimally configuring the supply networks to achieve maximum resilience with minimum COGS impact (see table 4), will companies be able to effectively shield against the next unknown event. In 2023, companies will continue to leverage supply chain stress-testing and digital twins to guide risk-adjusting networks in a fact-based manner.

2. Include supply risks and opportunities in commercial contracts, pricing, and commitments

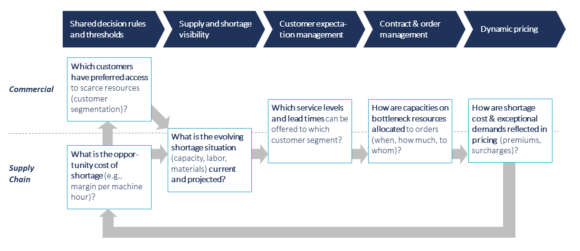

Secondly, in an increasingly volatile and disruptive environment, a silo approach between commercial and supply chain/operations functions can no longer be successful. When high utilization of assets, labor, and material shortages cause bottlenecks, this information not only needs to be systematically reflected in commitments of sales contracts and lead times promised to customers, but also in pricing decisions. For example, when incoming new orders are blocking capacity on highly utilized manufacturing lines, prices should be automatically adjusted to reflect shortage risk or potential lost sales with priority accounts. The same goes for applying mark-ups for rush orders not compliant with the agreed lead times. As illustrated in table 5, a new level of dynamic integration between commercial and supply chain is needed, starting with aligned decision rules, full visibility of current and future shortages by line/product, consistent customer expectation management balancing market needs and operations flexibility, and seamless integration in contract and order management as well as pricing. The S&OP/IBP process should continuously monitor and adjust the above to maximize overall profitability.

3. Incorporate uncertainties and constraints of supply in planning and parametrization

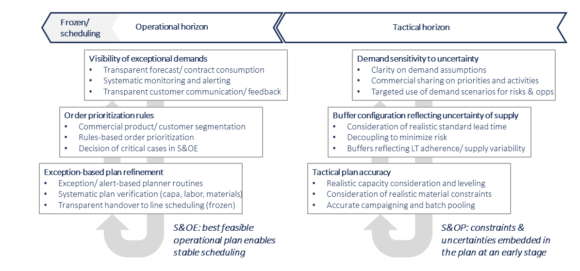

The third imperative is to adapt supply chain planning to the hyper-turbulent and uncertain environment. At the most basic level, the core capability needed is being very strong at integrating constraints and uncertainty in the plan. Interestingly, this is still a weak point in many planning processes, which overly rely on single-point planning and deterministic lead times, and do not systematically integrate constraints in the tactical planning horizon (e.g., 3-24 months out), when there is still sufficient lead time to prepare and react. As illustrated by table 6, the new environment requires an anticipative planning approach, where constraints (e.g., capacities, material availabilities, campaigns) and uncertainties (e.g., scenarios for risks and opportunities) are systematically embedded in the tactical plan, both in terms of buffer sizing and supply planning. An S&OP process with a forward-looking focus on constraints and uncertainties is a must in this environment, where short-term firefighting is no longer sufficient to manage the volatility, but effective anticipation of risks is needed. In the operational horizon and S&OE (e.g., 0-3 months out), a strong focus on exception-based management is needed, eliminating inconsistencies e.g., with the latest demand or materials availability, and handing over a 100% feasible and well-constrained plan to detailed scheduling. Only by following such a stepwise and anticipative approach, can operations be systematically protected from variability, enabling cost-effective production and sourcing.

4. Update master data, planning parameters, and pressure-test process stability

Fourthly, we need to accept that the new environment does not forgive basic supply chain flaws. The precious time, energy, and management attention must be reserved to deal with external shocks and disruptions, and not wasted to deal with avoidable internal mistakes. Unfortunately, there are still too many self-induced inconsistencies and structural weaknesses which drive a lot of variability in supply chains, to name just a few: incomplete or not correctly maintained material master data, lack of adherence to own process standards (e.g., adherence to lead times for demand submission, order confirmation, PO creation), and unstable execution (e.g., weak lead time and volume reliability).

Improving master data, adherence, and stability (what we call the process health indicators) is not about the next supply chain hype cycle, but about shifting the focus back to the basics of supply chain management with an incessant, day-by-day focus on process health monitoring and improvement. This includes a systematic measurement concept along the end-to-end supply chain, the daily/weekly integration of process health in operational routines (e.g., in shift handovers, weekly supply reviews), and a focus of management on structural improvement, e.g., by integrating process health trend analysis and improvement in monthly or quarterly management reviews.

5. Leverage the lessons learned from past disruptions

Lastly, we need to acknowledge that the above-described improvements require a substantial change effort from supply chain associates. Fortunately, many supply chain leaders have learned their lessons from the adverse events in 2021 and started to transform their organizations and enable their teams. These efforts need to continue. Moving from firefighting towards anticipation of risks, from supply planning and execution to supporting dynamic customer expectation management and pricing, as well as from focus on the short-term to the mid-term horizon. In many ways, supply chain associates need to change deeply engrained ways of working to support and drive the new supply chain methods.

Such a transition needs active support and enablement of the transformation process. While the topic has many facets, we just want to name three key prerequisites: Firstly, the changes described above need to be baked into aligned supply chain processes and routines and implemented with a high degree of process discipline. While it is natural to focus on short-term issue resolution, a consistent focus on issue anticipation is much harder to sustain and needs to be systematically trained and enforced. Secondly, risk mitigation, data accuracy, process adherence, and stability need to be methodically measured, monitored, and managed as part of performance dialogues. And thirdly, operations and commercial management needs to understand, role-model, and actively support working towards the new supply chain imperatives.

Not Rocket Science … but Back to the Basics, Enabled by Modern Methods and Technology

In a time when supply chain management is becoming a top priority in many board rooms, the bar for success is rising, and business leaders are expecting a different level of value from their supply chain function: protecting the business from systematic supply risk. Dynamically optimizing order allocation and pricing in collaboration with commercial. Creating robust tactical plans by continuously integrating the latest knowledge on constraints and uncertainties. Contributing to stable and cost-effective operations in difficult times.

The good message is none of the above is rocket science. Clear end-to-end concepts, value-adding processes and routines, and strong cross-functional collaboration are the key ingredients that can create major positive impact on the business. The first step forward for business leaders is to assess their organization’s maturity with regard to the five imperatives, as a basis for target-state design and implementation.