Effective supply chain segmentation can be a powerful value driver for a company. By clearly differentiating operating models it helps to cope with today’s immense supply chain complexity.

Complexity Raises Pressure on Pharma Supply Chains

Today’s pharma supply chains see themselves confronted with continuously increasing complexity on different levels: new product launches let the portfolio grow and more differentiated production technologies increase the number of dosage forms per product even further. Modern products require new delivery models, for instance direct-to-patient deliveries or even closed-loop supply chains for individualized treatments. And even commercial models have been changing significantly over the last years: the trend is shifting towards outcome-oriented models focusing on integrated diagnostic and treatment solutions.

This is a huge challenge for modern pharma supply chains as demand characteristics and requirements differ massively between different products in the portfolio or even between the same brands in different markets, e.g., developed markets vs. distributor markets. Demand is typically driven by different factors, like launch/reimbursement timeline, competitive treatment landscape, tender business, or parallel trade, just to name a few. Also, value drivers differ significantly between sales channels, products, and distribution models. While for classical small-molecule drugs with medium to high wholesale demand the focus is typically on stable and cost-efficient supply, tender-driven products require much more agile supply structures to be competitive.

All these drivers, characteristics, and requirements need to be managed adequately to provide supply chain services in the most effective and efficient way: modern supply chains need to be highly differentiated while building on a strong foundation of common elements. Supply chain segmentation is a critical enabler for that.

Rethinking Supply Chain Segmentation

As a concept, supply chain segmentation has been around for many years. Nevertheless, it frequently falls short of the high expectations placed on it. Based on our experience from many supply chain transformations in the pharma industry, we at CAMELOT see three key principles to move from concept to reality and leverage the full potential of supply chain segmentation:

1. End-to-end but purpose oriented

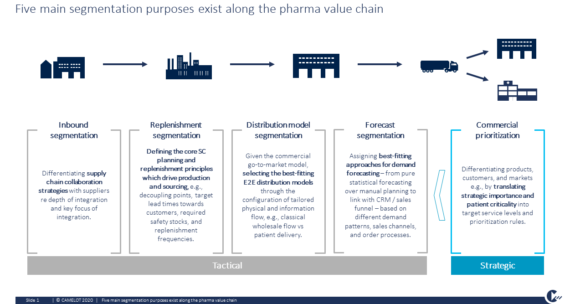

While targeting the supply chain end-to-end, a segmentation needs to have one clear and distinct purpose to be effective, instead of aiming to solve a mix of different questions in one step. It means that there is not one comprehensive segmentation supporting all supply chain decisions but rather a set of different segmentations that paint the full picture. We see five main segmentation areas to manage the complexity along a typical pharma supply chain: from commercial prioritization as guiding segmentation on strategic level to the more tactical areas of forecast, distribution model, replenishment, and inbound segmentations (see figure 1).

2. Fact based & data driven

Quite frequently, we observe that segmentations are limited to simplistic ABC/XYZ approaches just taking product volume/importance and variability into account – consequently delivering only limited results. To best serve the segmentation purpose, relevant segmentation dimensions and their thresholds need to be derived from facts rather than gut feeling: supporting a commercial prioritization for instance typically includes criteria like contribution margin, therapeutic essentiality, and strategic growth with the aim of differentiating target service levels and safety stock levels and of maximizing profit. In contrast, replenishment segmentation focuses on supply chain criteria like demand volume and variability, FDF pooling factor (i.e., how many finished products are produced from the same bulk product), and changeover times with the aim of ensuring stable and efficient supply. Based on these different target functions, the thresholds between segments need to be derived analytically.

In this example, technology allows a different level of segmentation: first, it allows to include more available data relevant for one specific segmentation, e.g., commercial prioritization. And secondly, it enables end-to-end optimization by not just focusing on one segmentation but connecting different segmentations.

3. From one-off to adaptive

Far too often, we see segmentations being conducted as one-off activities, for instance during a performance improvement initiative. As a result, segment definitions and derived strategy assignments become outdated as circumstances change. It is therefore of critical importance for the value of a segmentation that segments are reviewed regularly (up to daily, depending on the segmentation purpose) and attached strategies are updated continuously. Applied to full extent, modern segmentation automation enables this regular renewal process without any manual effort, for instance when reviewing and updating demand variability profiles as input for buffer stock calculation. This requires the use of decision support apps which are integrated with the supply chain data lake and seamlessly return segmentation changes to product master data and planning parameters.

All in all, supply chain segmentation is not an end in itself. It is only reasonable and worth the effort if it creates real value to the supply chain (and ultimately to the company). We have seen these benefits in many supply chain projects – from significant top-line effects through increased product availability to substantial bottom-line results, e.g. based on working capital reductions and efficiency improvements.

Case Study: End-to-End Supply Chain Segmentation

In a recent project at a mid-size pharmaceutical company, we designed a differentiated supply chain based on three separate segmentations linking the supply chain end-to-end:

- The commercial prioritization as strategic segmentation towards the market combined strategic product importance (e.g., due to growth potential) with product essentiality (i.e., the impact towards the patient). It determined, for instance, the required service level as input for target inventory definitions to ensure adequate market supply.

- While the required service level is independent from metrics like demand volume and demand variability, the fill & finish segmentation (as part of replenishment segmentation) further upstream takes these characteristics into consideration. Combining demand volume and variability on SKU level, four main replenishment archetypes could be identified that range in a continuum from weekly replenishment patterns for high runners (i.e., well plannable high volumes) providing a stable base load in production, to flexible on-demand replenishment for exotic products with rather sporadic demand. By defining different levels of flexibility for the different archetypes, we were able to better leverage the benefits of flexibility (e.g., producing the product on short notice, allowing short notice changes to the plan) for those products that need it most.

- This was aligned with the bulk and manufacturing segmentation – the second part of replenishment segmentation – where bulk decoupling strategies were defined not only based on demand volume and variability on bulk level, but also considering the FDF pooling factor (the number of FDF being served by one bulk product), replenishment lead times, and storage limitations. While high volume bulk products (which typically supply many FDF) with rather stable demand qualify for bulk decoupling, we defined make-to-order strategies for products with low but fluctuating demand on bulk level.

By linking these three segmentations, we were able to define a clear end-to-end replenishment configuration for all products optimizing inventories along the supply chain by >20%. At the same time, lost sales and order backlogs as well as customer penalties were significantly reduced.

Enabling Segmentation with Systems of Intelligence

While modern planning tools offer some basic segmentation functionalities, the full power of modern segmentation approaches are typically not supported in standard planning software. This gap is closed by specialized tools which fully leverage the potential of multi-dimensional, data-driven, and continuously updated segmentation.

These segmentation tools are usually fully integrated with the system landscape and retrieve required information directly from advanced planning tools and ERP systems. They typically utilize machine learning algorithms to identify best-fitting supply chain segments, attach planning strategies and tactics fully automated based on defined rules, and communicate the segmentation results back

to the planning and execution systems. With this closed information loop, segmentation-based planning decisions can be fully automated and integrated into the planning process in real-time.

This allows companies, for instance, to fully automate the selection of adequate forecasting models, the definition of proper inventory levels, or an optimum product-to-line allocation within production – to name just a few use cases.

How to Start?

Supply chain segmentation is not an end in itself – but modern supply chains can’t be successful without proper usage of segmentation approaches. Effective segmentation can be a powerful value driver for a company by clearly differentiating operating models to cope with today’s huge supply chain complexity.

As for every journey so it is for segmentation: it is important to take the first step. This should be a review of current, typically rather fragmented, and sometimes outdated segmentation approaches being used in the company. Identifying the most promising use case, and thus the segmentation purpose, to set up a segmentation pilot will quickly deliver tangible results and help to create broader business understanding for the new logic. After a thorough review of first results and once first benefits have become visible, the segmentation logic is ready to be extended along the supply chain to make it a real end-to-end approach.

We are excited to hear about your individual challenges and use cases! Reach out to us and let’s discuss how to shape your future supply chain!