In times of uncertainty, cash is king again

In the aftermath of COVID-19, companies are sailing in unchartered territory: the fade out of government support might stress global supply chains with a wave of bankruptcies, consumer patterns have fundamentally changed, and global powers engage in a trade war with uncertain outcome. To face such uncertainties, CFOs need to stock up their cash war chest – and working capital management becomes a central focus.

Working capital management aims to release internal sources of financing for the operations of a company. Often, this is achieved by improving payment terms, a measure which is perceived as painless because it is outside of a firm’s core operations. But to generate better and longer-lasting contributions to a company’s performance, a new approach is needed. This time, the focus must be on structural improvements in supply chain (SC) processes.

Working capital management must focus on underlying supply chain processes

We have analyzed the working capital performance of leading firms in the Pharma, Chemical and Consumer Goods industries (see fig. 1).

Figure 1: Comparison of the working capital management efficiency at leading firms in 3 industries

Looking at the Cash Conversion Cycle (CCC) as an efficiency measure for working capital management, we can see large differences between the three industries, and between the leaders and laggards within each industry – pointing to potential for structural improvements especially in the Pharma and Chemicals industries.

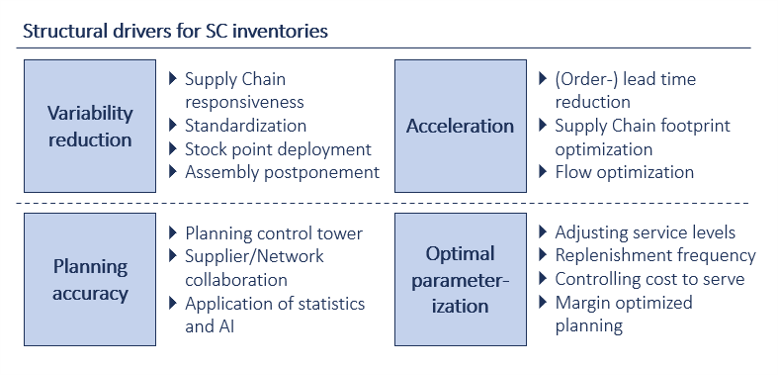

A new approach must focus on structural drivers of working capital, which are found within SC processes and their throughput times. SC processes integrate entire value creation stages from raw materials to customer service, and consist of manufacturing and logistics steps, transit phases and inventories. SC processes can be improved structurally by addressing the underlying drivers of inventory along them: process variability, planning accuracy, requirements on speed and flexibility, and the overall parametrization (Fig. 2).

Figure 2: Structural drivers of supply chain inventories and example improvement levers

Four principles should be considered when planning the approach:

- Map the value creation curve to identify the SC processes where improvement action translates with strong leverage into working capital reductions. E.g., finished products processes have a higher accumulated value than raw material processes. Throughput time reductions in the former therefore translate more directly into DoH reductions.

- Focus on structural process improvements along the end-to-end SC (Fig. 2). Not only will this unlock lasting and outsized contributions to working capital reduction, but it will do so while maintaining the same service levels and risk exposure.

- Prioritize levers for structural improvement following the min/max principle, by which actions with strong contributions but limited costs and operational impacts are prioritized. Even if big working capital improvements are tempting, they must not be achieved at the cost of operational stability.

- The first step of an improvement initiative should always be the creation of transparency on inventories along the end-to-end supply chain. Once this is done, the SC parametrization can be adjusted –often with zero process impacts and limited costs.

Recently, CAMELOT has supported a mid-sized pharma company at defining their approach to working capital management. The initial analysis revealed an oversized days on hand measure, which was driven by a large finished product inventory at the top of the value creation curve. By improving demand forecasting, decoupling upstream buffers for a better differentiation of inventory levels, and increasing the packaging frequency, we were able to reduce the throughput time and to focus on areas with biggest leverage into working capital – while maintaining the same service and safety levels.

Supply chain strategy as the key motor for company performance

Supply chain optimization still holds the opportunity to make a step change in company performance. But a balanced approach that spans the full value chain, from sourcing to customer service, and that focusses on structural process improvements, is needed. Our supply chain centered approach to working capital management is a prime example: We extend our action beyond payments terms and focus on processes to reduce throughput times, inventory levels and buffers – fundamentally reducing the overall inventory in which working capital is locked up.

Our principles guide cross-functional project teams to focus their action on processes were the biggest impact into working capital can be achieved; all while a balance between capital, cost, service, and risk is maintained. Process improvement usually has positive impacts on other dimensions too. Working with the mid-sized pharmaceuticals company mentioned above, we have shown how improved demand planning and decoupled buffers not only reduced their days on hand measure, but also strengthened dimensions like supply chain resilience.

Major contributions to a company’s financial performance can be unlocked by structurally improving processes and throughput times in the supply chain. To make supply chain strategy a true motor for business performance, managers must look beyond one-dimensional targets like cost reduction and start linking supply chain design and operations with fundamental capital requirements, business growth and sustainability. Finally, supply chain performance and working capital management must be understood as a journey for continuous improvement and be embedded into existing management processes.

We thank Sebastian Küng for his valuable contribution to this article.