Today’s supply chains face huge challenges: Sudden changes in customer demands as we saw in lockdowns during COVID-19 call for agile supply chain planning. Severe disruptions of transport infrastructure from natural disasters and simple shortages in transport capacity show the limits of existing resilience concepts. What is the state of today’s supply planning?

We see that many organizations are struggling with basic supply chain management requirements such as end-to-end visibility. Automating an end-to-end supply plan that is centrally controlled seems a far-away since the planning foundations are not adequately built and an organizations’ maturity level is not evolving. Centrally controlled end-to-end supply plans without a local focus are determined to fail. As a result, we can frequently observe one or more of the following effects:

- The Forrester Effect induced by forecast error and MRP propagated demands along supplying nodes

- Operational protectionism to artificially enforce plan stability

- Increased inventories to protect service level targets

- Limited organizational capabilities and maturity levels to ensure that supply planning processes are connected and synchronized end-to-end

- Large technology investments do not effectively deliver on the initial business objectives.

I would like to outline in this and the next article what is actually happening in today’s supply operating models, how this takes place and why. Finally, I would like to discuss what needs to be done to leverage the opportunities of a new end-to-end supply planning model.

Today’s end-to-end supply planning models

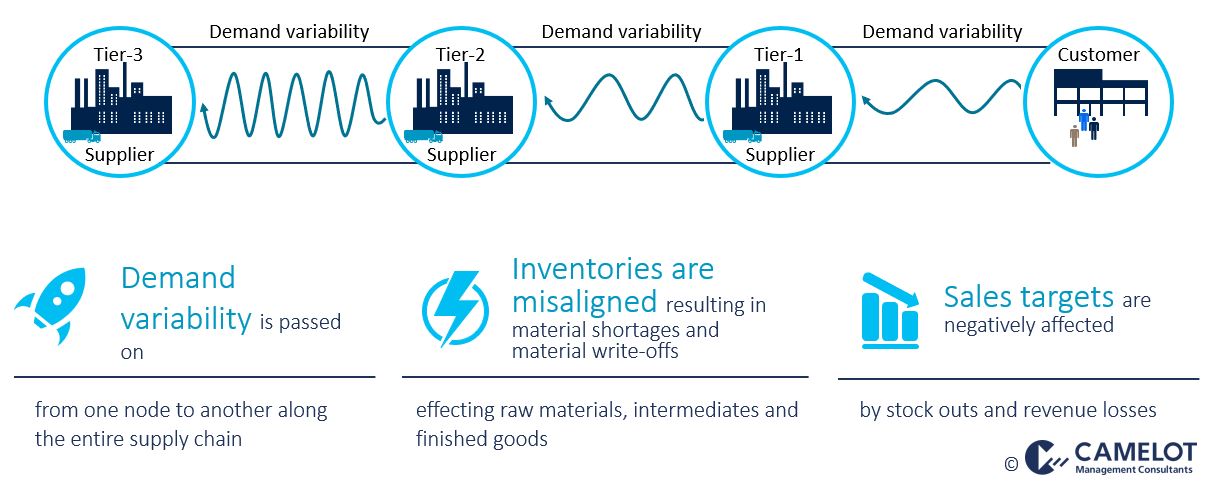

Figure 1: Today’s end-to-end supply chains

Despite the hype around digitalization and disruptive technologies we observe that many companies still struggle with the same challenges that have been present for the last 40+ years. Among those are still too many functional and local silos, unconstrained MRP propagates supply plans that are subject to forecast errors, end-to-end misalignment of supply parameters, and lack of analytical truth.

This results in demand variabilities that are passed down the entire supply chain node by node. Inventories are misaligned and either too low or too high, resulting in stock-outs that negatively impact sales targets, or revenue losses. In addition, conflicting priorities and misaligned performance metrics can be observed. In principle, organizations struggle to gain something that nowadays seems to be very basic: end-to-end visibility of a supply chain’s true capability.

Disruptions triggered by the COVID-19 pandemic underlined the urgency to achieve more agility and resilience in supply planning. In my next post I will outline why today’s supply planning frameworks struggle to be effective and what are the opportunities to transform to a new supply planning operating model – one that ensures high service levels as well as the right inventories to safeguard supply, and that allows a company to control and configure end-to-end supply plans.

In the following post, I will explain how this happens and why. I will also highlight the chance for a new end-to-end supply planning framework.