AI-Driven Application & Process Testing: Embracing Agentic Testing

Learn how Agentic AI enables digital transformation, delivering true hyperautomation.

The order-to-cash process was neglected for many years. However, recent studies show that many companies are now transforming it or plan to do so in the next few years. But what does this mean and which benefits can be expected? Let’s figure out the value of transforming the order-to-cash process!

The first blog article of this series introduces benefits and a maturity model for order-to-cash (OtC) processes. This article details the business case. The concluding third article focuses on Digital OtC.

In this series’ first blog article, we introduced a maturity model for order-to-cash processes with five stages from react (1) to anticipate (2), integrate (3) and collaborate (4) to orchestrate (5). When it comes to the maturity of order-to-cash processes, studies show that the majority of companies sees themselves at the second maturity stage “anticipate.[1] This stage is characterized by standardization and defined workflows within the single functions. Process governance and Centers of Excellence are introduced within the functions. However, lacking synchronization amongst the functions regularly results in cross-functional escalations. Missing integrated end-to-end processes and systems further enforce the escalation potential (more details in our first article Order-to-Cash Process: Why You Should Act Now). In this way, companies miss out on the many benefits that come with a higher maturity level. With increasing process governance, automation, system integration and a clearly defined process organization, profits can be raised, cash flows optimized, and employee satisfaction improved.

At the same time, we must not forget what customers actually expect from the order-to-cash process. And the question arises as to why companies do not act even though there are benefits to be expected? We will discuss these two essential points first.

Companies face new challenges due to changes in customer behavior. COVID-19 has given business-to-consumer (B2C) ecommerce a boost. In Germany, gross sales of goods in e-commerce rose by 19 percent to EUR 99.1 billion in 2021 compared with 2020.[2] The changed buying behavior is affecting business-to-business purchases as well. Therefore, business customers are expecting fast and simple options to order goods via CRM systems and require an accurate availability confirmation comparable to their private purchases. They also expect end-to-end process visibility starting with transparency on the stage of their sales order and ending with managing their returns. These expectations pose a challenge for many companies as they have neglected the order-to-cash process in recent years. Investments in automation, system integration and the resulting end-to-end transparency have not been sufficiently realized.

As the order-to-cash process is an end-to-end process, it involves many functions and interfaces. On top of that, process variants, e.g., for different products, customers or regions need to be respected. Due to this complexity, there can be no standard order-to-cash solution which is directly usable in each company. With this in mind, many companies procrastinated the required transformation of their order-to-cash-processes. By now, however, the majority of companies is currently transforming their order-to-cash process or plan to do so in the next few years.[1] In the following, we will explore the benefits within the process steps and companywide.

Successful order-to-cash transformation can be subdivided into three major steps. First, the organization must be prepared for the transformation and provide its buy-in. Second, the focus must be on process governance to establish harmonized processes. In the last step, the processes are automated to meet the company’s specific requirements.

There are some prerequisites in mindset and organization that build a foundation for a successful change: Acknowledging that the order-to-cash transformation involves systems, processes and people is essential. Therefore, the buy-in of all involved functions is required as they execute the processes afterwards. Additional organizational change management supports the cross-functional acceptance from end user to top management. Last but not least, it needs to be recognized that some transformation benefits, as a reduced error rate or quicker order confirmation, occur instantly. Other benefits, e.g., increased revenue or improved customer experience, need time to payback.

Implementing a company-wide process governance forms the basis for the order-to-cash transformation. Process governance results in harmonized processes and process variants which are transparent and documented according to standards. In addition, clear roles and responsibilities are defined along the process determining the process ownership, functional roles, and interfaces. Improvement is ensured with integrated quality and performance management consistent process execution and a continuous process.

Next, the standardized processes from order creation to dunning can be automated, e.g., with RPA and AI. Besides the obvious efficiency gains from automation and the resulting cost savings, there are further advantages. One benefit is the inherent high process quality. The process is consistently executed and the error rate, e.g., for order creation or delivery, is significantly reduced. Another benefit is the fast process execution. The customer values the quick order confirmation while the production or fulfilment is directly informed about the incoming order. The high process quality and the quick execution foster further cost savings as less deductions per order or penalties for late fulfillment are required.

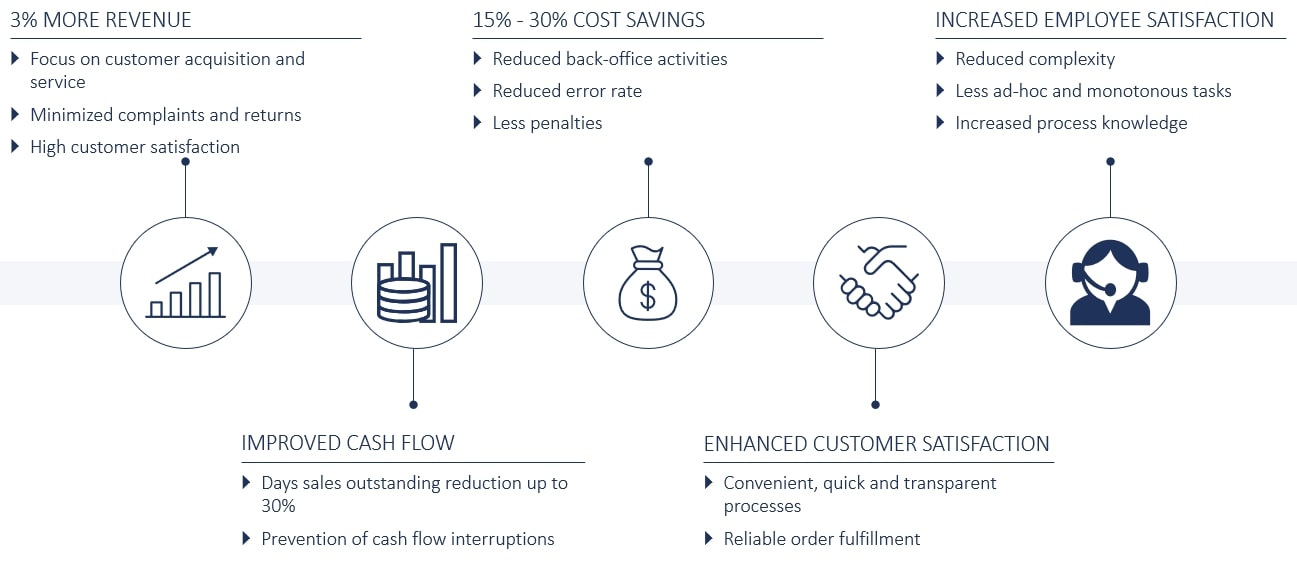

Company and customer can expect quantitative and qualitative benefits from an order-to-cash transformation. Figure 1 summarizes the highlights:

As the order-to-cash transformation streamlines the entire process from order-to-payment, various levers can generate up to 3 percent more revenue.[3] The factors that can come into play start with a highly automated order management. With this, the sales force can focus on acquiring new customers and enhancing service for existing customers. The revenue is further increased by implementing dynamic pricing and promotions as well as a more accurate fraud prevention. Quick order confirmations, reasonable delivery dates and sales & operations planning (S&OP) assure that less orders are cancelled by either the customer or the company. By delivering on time, in full, in the required quality, complaints and returns are minimized. All of these factors additionally increase customer satisfaction.

The finance organization, especially the accounts receivables department, is essential to assure the cash inflow. After the order-to-cash transformation, all finance processes from digital invoicing to collecting outstanding debts are accelerated. Together with a process-wide high level of automation, prevention of bottlenecks and appropriate inventory levels, days sales outstanding can be reduced by 30%.[3] Furthermore, the increased transparency allows to track exceptions and disruptions earlier while facilitating quick intervention and resolution. With this, interruptions to the cash inflow are prevented.

Order-to-cash transformation enables 15 percent to 30 percent cost savings through efficient processes.[3] Thereby, process automation is essential as it reduces back-office activities e.g., by automating order creation, digital invoicing and cash application. In addition, it reduces the error rate as no manual data entries are performed. As the order-to-cash transformation increases the reliability of the entire process, fewer penalties for late or incomplete orders need to be paid.

On top of the reasons already mentioned, a better customer satisfaction can lead to increased revenue as well. There are two aspects that are most important to the customer:

Both are promoted by the transformation. This leads to an enhanced customer satisfaction and improved brand perception that in turn encourages repeated purchasing.

Last but not least, an order-to-cash transformation reduces the complexity and the amount of ad-hoc tasks for many employees by assisting them with higher transparency and stronger system support. In addition, many of the monotonous tasks are automated which frees up time for more value-adding tasks. Besides, analyzing, standardizing, and optimizing the processes during the transformation increases the process knowledge of many employees.

Transforming the order-to-cash process is a challenge. Streamlining processes, people, and technology requires high engagement and investment. However, it pays off. Revenue increase, supported by higher customer satisfaction and cost savings directly impact the profit. Shorter days sales outstanding and an improved cashflow assure liquidity. Enhanced employee satisfaction is essential in the war of talent.

In the next blog article, we will explore the opportunities of the digital transformation of order-to cash.

__________

Transforming the order-to-cash process can lead to a stable cash flow and better response time towards customers, adding to a good customer experience. Still, the process has been neglected in many companies. Our blogs series shows the benefits of investing into order-to-cash processes.

__________

[1] PowerPoint Presentation (apqc.org)

[2] Onlinehandel: Corona-Jahr 2021 beschert E-Commerce in Deutschland Wachstum – manager magazin (manager-magazin.de)

[3] Order-to-Cash Platforms Are the Future (bcg.com)

We would like to thank Miriam Prein for her valuable contribution to this article.

Learn how Agentic AI enables digital transformation, delivering true hyperautomation.

Reimagine resilience and proactively minimize supply chain risks

This article shall help you to understand how to optimize your inventory positions in a month – or even less.

Modern PLM systems empower businesses to achieve product excellence in fast-paced markets by enhancing collaboration, agility and innovation.