The plastics industry is ready to scale up a closed-loop circular economy due to the recent advancements in recycling technologies and increasing demand for recycled plastics. All players must take concrete steps by realizing a collaborative network design, establishing a circular value chain, and investing in new high-quality recycling capacities. Otherwise, the whole industry risks to lose market shares permanently when plastics are substituted by other materials due to their unsustainable linear use. Each player must contribute to the shared effort but will also benefit from the huge value opportunity of circular plastics.

What Does It Mean to Advance Circularity for Plastic Waste from Packaging?

Buying groceries nowadays, we often end up with a lot of plastic packaging in the trash bin. Brands ensure high quality and hygiene standards for their food and drinks by using lightweight and low-carbon plastic packaging. The packaging preserves the product´s freshness and extends its durability significantly. Hence, plastic significantly reduces the global amount of food waste.

However, plastic from packaging today is mostly used linear, wasting resources, and generating pollution. Its material properties are inherently suitable for a circular life cycle though. Several new recycling technologies work economically at an industrial scale to meet the urgent demand for post-consumer recycled (PCR) plastics with food-grade quality. The European Food Safety Authority just announced an easier approval process for the use of plastic recycling technologies for food-contact recycled plastics. Brands, consumers, retailers, and politicians drive demand for circular plastics, esp. in packaging. Consequently, plastic producers and converters have become committed to establish a circular eco-system. In a shared stakeholder effort, industry associations agreed on and publicly announced tangible targets:

- 10 million tons of recycled plastic should be used in products by 2025 (EU CIRCULAR PLASTIC ALLIANCE) (for reference, ~50 million tons of plastics are used in the EU each year).

- 50% of plastic from packaging should be recycled by 2025 (EU Packaging directive),

- 25% to 50% of post-consumer recycled plastics should be included in packaging and only sell 100% recyclable packaging by 2025 according to the commitment of many large brands (THE GLOBAL COMMITMENT BY EMF).

Despite the known advantages of plastic circularity and its technical feasibility, a large-scale plastic recycling value chain is not yet in place. Only about 4 million tons of total about 50 million tons of Europe’s demand for plastic is covered by recycled plastic, which in the majority is downcycling for low value applications (The Circular Economy for Plastics – A European Overview). Stakeholders lack a concise framework, which displays the required resources, a harmonized network design, and concrete actions to achieve the circular plastics vision.

Enabling Circularity for Plastics Requires a Collaborative Network Design, Yielding Mutual Benefits

To realize plastic circularity and exploit its full potential, an end-to-end value chain for plastics must be envisioned and planned in a cooperative network design. All stakeholders from various sectors must collaborate and coordinate to design and build an efficiently working and cross-industry eco-system for the plastic recycling supply chain to enable food-grade recycling economically viable at scale. This includes retailers, brand-owners, plastic converters, waste service providers, plastic producers, and plastic recyclers. The circular network design for plastics develops around a set of key decision criteria and challenges.

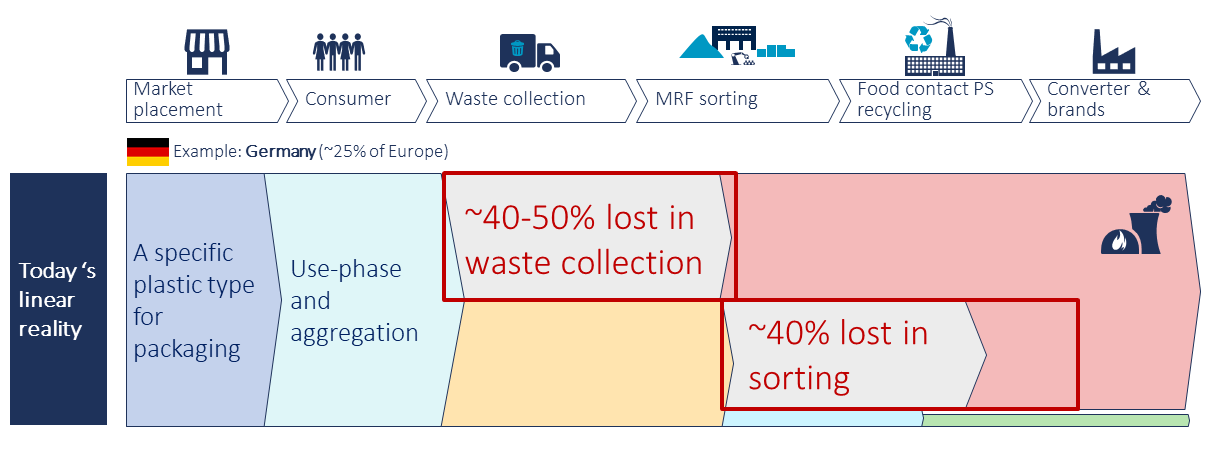

Sufficiently Sorted Plastic Waste as Feedstock Is the starting Point for a Recycling Value Chain

As the first step, waste is collected from private households and businesses, and sorted at material recovery facilities. These need to produce deliberately sorted plastic waste, usually bales, which are the feedstock for the actual food contact recycling operations. A quantitative assessment in one of our studies displays the following ratios for a specific type of plastic waste stream. Even though a reasonable amount of plastic from packaging is theoretically available for recycling, about 80-90% of post-consumer plastic waste is lost due to inadequate collection and sorting. For Germany, studies show that this amount is about 49-50% of PCR plastic waste. Frankly, commercial plastic waste from offices, businesses, schools, universities, and other public facilities is mostly directly sent to incineration, instead of being adequately sorted. Another 40-45% of the plastic packaging waste is lost during the sorting operation. Typically, operators of material recovery facilities are incentivized to focus on volume throughput instead of purity and recovery rate. Only a shared effort of brands, retailers, plastic converters, waste service providers, politicians, and consumers can expand and advance the already existing plastic packaging waste recycling system to achieve a long-lasting sorted plastic waste stream for circular plastics:

- Businesses and public facilities could integrate a separated waste disposal system (e.g., the yellow bin).

- Politicians could compel separated waste disposal and further, deliberate collection or sorting of commercial waste per law.

- Material recovery facility operators could shift their operational business model from maximizing volume throughput to obtaining higher purities and recoveries of plastic waste.

With a shift in consumer mindsets and EU regulations in place, substantial demand for recycled plastics for food grade exists and will accelerate by time. Hence, generating a reasonable amount of quality plastic waste as feedstock forms a shared objective and stimulates reconsideration of current business operations.

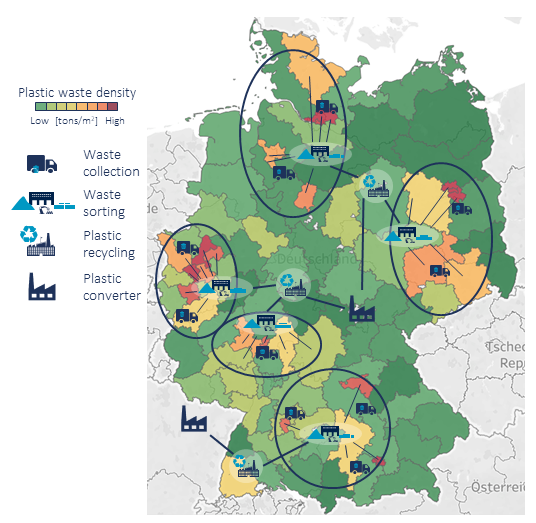

A Network of New High-Quality Recycling Assets Needs to Be Designed Along Clear Criteria

New high-quality recycling assets are required to achieve sufficient quantities and quality of food-contact recycled plastics. For an efficient supply chain, key decision criteria for collaborative network design must be considered for the placement of the new capacities. Accordingly, the suitable location of the recycling plant and its design itself need to be determined. Important decision criteria are the following:

- The associated costs to transport sufficient volumes of feedstock between plastic sorting facilities and the actual recycling plants need to be weighed against other procurement, operations, and investment costs. Resulting from our analysis, transport costs amount to ~6-10% of the overall recycling costs. However, once reaching a transport distance of ~500-600 km (and more), logistics exceed a critical threshold and become a cost burden. Hence, identifying a profitable waste catchment area, which generates a reasonable amount of PCR waste while minimizing transportation distances, is crucial for the cost-driven decision-making about the placement of recycling plants.

- Recycling asset size and capacity need to be assessed based on the selection of a qualified recycling technology and demanded volumes of the plastic waste stream in food grade quality. As of today, no comparable recycling facility exists, which produces recycled plastics granulates in food grade quality in industrial volumes, except for rPET.

- To minimize investment expenses, cost estimations need to be drawn for both, brownfield, and greenfield Our quantitative evaluation predicts up to ~26% investment savings for a brownfield approach.

- Labor costs amount to roughly 9% of total recycling costs and vary between the federal states in Germany. However, attractive sufficient workforce is a decisive factor. One recycling facility of industrial size (~40-60 kilo tons per year) requires ~50 qualified employees, from which ~10% require with an engineering education and the rest being skilled workers. On the one hand, the salaries in economically weak areas may save up to ~30% compared to strong ones. On the other hand, the German industry association for waste management and recycling, BSVE, calls out a Shortage for workers, for engineers, and skilled workers alike. Settling close to a university and an attractive area with unemployed skilled works or unemployed citizens for work training may help to fill the gap.

- Besides obtaining the operation license, building a recycling facility in an already existing industrial park ensures access to required utilities and services. Moreover, synergies with waste services and other stakeholders like plastic converters may reinforce the assessment and efficient utilization of the waste potential to secure sufficient recycling feedstock.

- Local business tax rates fluctuate depending on the federal state but have a significant impact on network design. Our evaluations show that business taxes may reduce profit from EBIT up to nearly 50%.

Stakeholders Must Collaborate to Advance Collection and Sorting of Packaging Waste

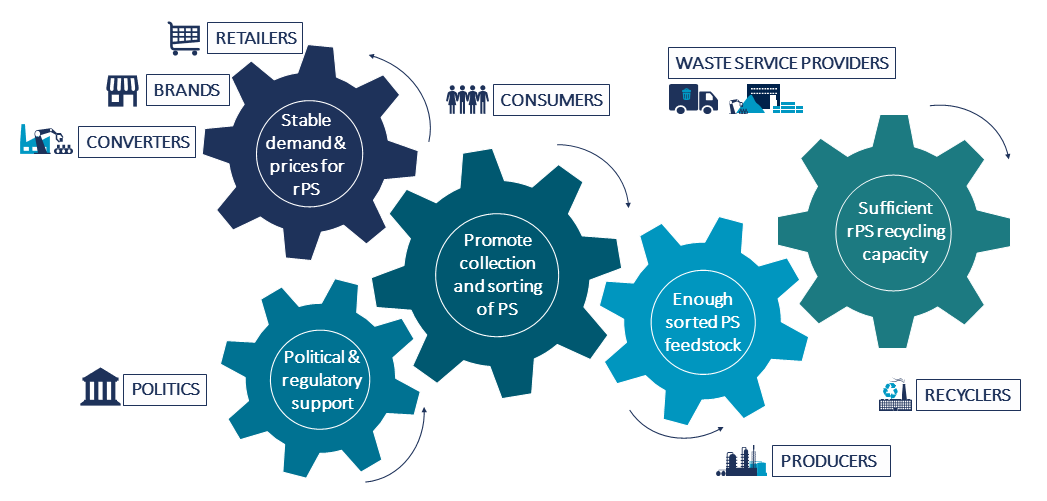

The establishment of a circular plastic value chain follows a clockwork scheme. Each gear must be in place and continuously moving to generate food-grade PCR plastic for packaging. Industry experts highlight the cruciality to first guarantee demand and stable prices for the output, the recycled plastic granulates suitable for food contact; secondly, to ensure sufficient input, post-consumer plastic waste from packaging; and thirdly, to invest in capacities for high quality recycling to establish a long-lasting circular plastic supply chain.

To reach the shared objective, stakeholder collaboration is the only way to activate all parts of the clockwork, seeking to improve input collection and sorting of plastic packaging waste. Each stakeholder needs to contribute to the joint effort but will also gain from the advantages in the long run.

- Retailers, brands, and converters need to

- commit to purchase a stable demand and stabilized prices for recycled plastics,

- educate the end-consumer about adequate waste disposal and advantages of recycled plastics in packaging,

- include post-consumer recycled plastic and recyclability in their product design.

- Politicians and policy makers must

- enact directives to stimulate investments in recycling (e.g., EU Green Deal) and enforce stricter collection, sorting, and recycling targets on EU and national level,

- on a national and regional level, permit and support placement and construction of new recycling capacities as well as assist with required boundary conditions such as workforce, infrastructure, taxes, etc.

- Waste service providers should

- shift their business model away from relying on fees to collect plastic waste relying on disposal (input) towards selling sorted plastic waste as feedstock for recycling (output),

- extend plastic waste collection and deliberate sorting of the commercial waste stream to reduce the losses of up to 85% of plastic waste as potential feedstock for recycling,

- pivot the recycling operation to yield better purity and recovery rates of plastic waste instead of maximizing volume throughput.

- Producers and recyclers should

- leverage proven high-quality mechanical recycling, solvent-based, and pyrolysis-based recycling technologies at an industry scale to yield food-grade recycled plastics,

- increase recycling capacities, e.g., by roughly 27 kt to reach 30% PCR in packaging for polystyrene,

- commit (contractually) to stabilize intake of sorting plastic waste as feedstock to ensure purchases to waste service provider,

- integrate recycled and virgin plastic production into circular eco-system yielding mutual benefits to generate synergies between operators.

Players Need to Act Now to Upscale Recycling Effort for Tomorrow’s Demand

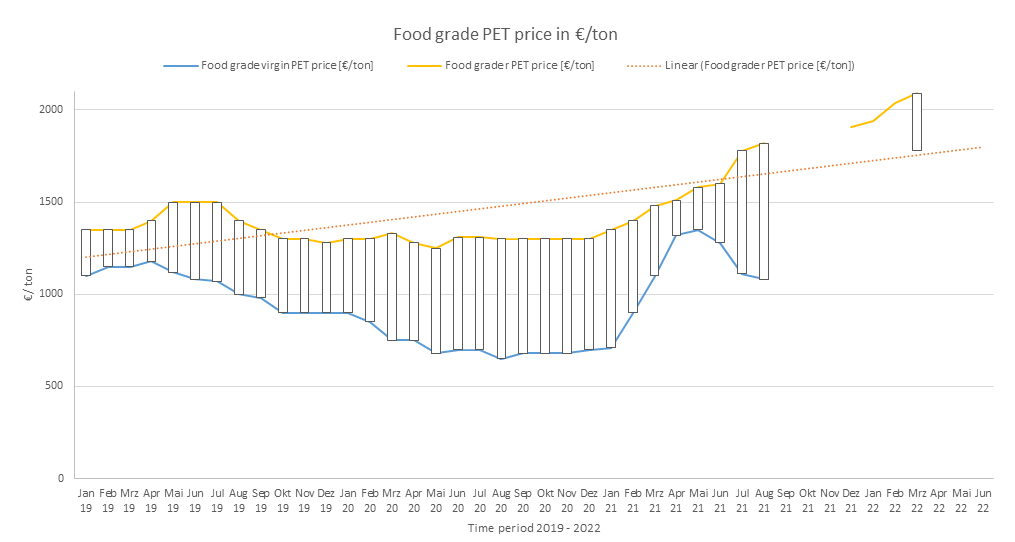

Making a step change in recycling shares is possible and allows closed-loop food-contact recycling for different plastic types but requires cross-industry collaboration and major investments. There is nothe purely linear value chain for plastics has no future. Companies must act now to meet the existing and increasing demand of recycled plastic. Otherwise, a plastic type may be simply losing market share, being substituted by more sustainable plastics or other materials, or the prices will increase for high-quality recycled plastic and supply cannot follow demand as we can see for recycled PET.

On the one hand, companies need to find their sweet spot in the upcoming circular value chain for plastics. On the other hand, a collaborative approach is necessary to allow for an efficient supply chain and coordinated network design to enable benefits and synergies for all stakeholders. Industry associations may be a crucial coordinator and may implement the political goals and regulations. With a shared vision, stakeholder collaboration enables a sustainable, long-lasting network and accelerate the transition to a mutual beneficial circular value chain.