There are tons of truths and analysis about Sales & Operations Planning (S&OP) and Integrated Business Planning (IBP) that at the end of the day seem obvious and are adopted in many organizations. So why is it still a topic? From our experience, S&OP in its standard form no longer delivers the desired results.

Sales & Operations Planning (S&OP) is a cross-functional process to align demand forecast and supply in volumes in a tactical range, meaning from one to 36 months. Integrated Business Planning (IBP) is the enhancement of S&OP to specifically reconcile volumes to values to drive better senior stakeholder decision-making. However, what is a well-known process in theory, very often does not deliver the desired results in practice. We see two key reasons for this.

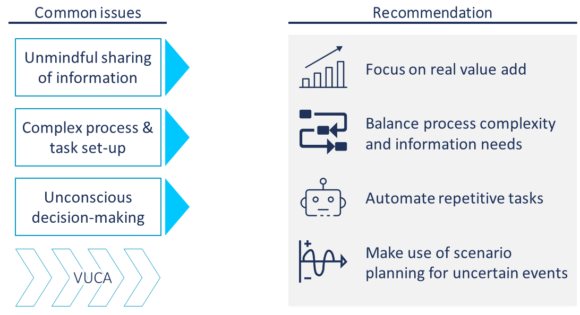

- The S&OP/IBP process does not support hard decision-making for cross-functional topics in the most effective and efficient way. In our consulting projects, we especially found unmindful sharing of information, complex process and task setup as well as unconscious decision-making to be most common and to have the largest negative impact.

- The VUCA (volatility, uncertainty, complexity, ambiguity) world is creating new requirements towards S&OP, which cannot be covered through classical planning tools. Covering aspects such as sustainability or resilience in the company’s core planning cycle, will make S&OP a differentiator, a true source of competitive advantage in the VUCA world.

This article describes our current perspective on a state-of-the art S&OP/IBP process. We start by lining out the most commonly found issues in S&OP/IBP, share our best-practice recommendations to mitigate them and describe the necessary enhancements to cover the VUCA world requirements before introducing an overall roadmap.

Common Issues in S&OP/IBP

When we break down the above-mentioned issues in S&OP/IBP, three plus one themes can be given.

Lost trust through unmindful sharing of information

One of the major mistakes made within the S&OP process is the creation and sharing of too large amounts of information. There is a high risk that raw data does not get adequately converted to meaningful information when e.g., system screenshots are shared in meetings. On top of that it is likely that a large amount of data does not get validated and checked carefully. Therefore, there is a risk of sharing wrong information.

Also, the shared data/information may not be appropriate for the audience. Operational information such as forecast accuracy are usually relevant for operational meetings on a lower level. If they are presented in senior-level meetings with cross-functional stakeholders, the impact of a forecast accuracy towards supply reliability and costs might not be known to everyone. The effect can be questions about the “so what”. In addition, information overload drives senior management away from focusing on risks and opportunities towards “checking off”.

Confusion by complex process and task setup

Complexity is the enemy of any organization. If the S&OP/IBP process is not established and embedded in the organization in the leanest way from the very beginning with a structured meeting cadence and clear roles and responsibilities, it will probably remain in competition with other meeting formats. This leads towards rather poor stakeholder experience and overall supply chain results. Complex S&OP processes and/or a bad meeting cadence are usually characterized by pre-alignment meetings, driving FTE workload and the sharing of information before actual S&OP meetings. People will have a different information level for the different topics, which might cause confusion. Furthermore, differences in information levels might be used for internal political purposes which will diminish rational decision-making. Finally, complex processes lead to difficulties in cascading decisions from S&OP meetings to operations.

Unconscious decision-making

A lack of understanding of the cross-functional S&OP decision-making process combined with siloed thinking can lead to unconscious decision-making and to cases where decisions are taken consciously wrong outside S&OP meetings. A common example are forecasts with buffers. Buffers lead to reduced forecast accuracy, increased inventory holding costs and eventually to write-offs. Even worse, in supply shortage situations, increasing a forecast will decrease supply for other customers or markets resulting in stock-outs that become more likely for the organization as a whole.

VUCA requirements

VUCA acts as an accelerator to the above-mentioned issues. When the situation is less clear or changes constantly and there is at least one of the above-mentioned issues the decision-making process enters a vicious cycle, it switches from senior management decision making process towards a workshop to align on pain points and root causes. Decision-making will then be brought back to operational silos which in the end will foster more root-causing in S&OP meetings. This should be avoided.

Recommendations to Boost your S&OP

To cover the above-mentioned issues but also to come to an efficient and effective S&OP/IBP process with a focus on cross-functional, forward-looking decision-making, we recommend considering the following five aspects:

Focus on real value add

To stay away from an overwhelming amount of information in meetings and keep preparation workload lean, we suggest starting the preparation for each meeting with the same questions: what kind of decisions need to be taken, and what kind of information will people need for that. All other information should stay in the closet. This usually means that in operational meetings on a lower level, operational issues such as forecast accuracy are discussed. Meetings with senior management are reserved for strategic topics such as the overall inventory strategy.

Balance process complexity and information needs

We strongly suggest following the “KISS” (keep it simple, stupid) approach for developing a well-organized S&OP process. This avoids overengineering. Start by matching supply and demand in a stable roll-up first. Use only few important KPIs for steering. If this works in a stable manner, increase the scope by carefully incorporating further aspects such as finance. A common pitfall is to go too fast for a scope enhancement because of operational pressure. We recommend taking your time when widening the scope because S&OP is a tactical to strategical process, and not meant to cover firefighting issues.

Automate repetitive tasks

To keep FTE workload low, and focus on real value add, an increase in automation is needed. Most KPIs can be automatically created in Power BI or in a tableau dashboard. To reduce the information flow towards stakeholders, define alert thresholds so that only important data is shared. More complex tasks can be automated with robotic process automation (RPA), even across different IT systems. Overall, we expect that S&OP workload for data preparation can be reduced by up to 90%.

Make use of scenario planning for uncertain events

One of the most powerful tools within S&OP/IBP is scenario planning. Scenario planning is useful to bring transparency for discrete events and to plan options systematically. In summary, discrete events are evaluated for likelihood and impact, e.g., the uptake curve from launch and reimbursement timings on stock levels. Then supply options are evaluated against the scenarios. Examples are high/low supply on cash flow, potential for write-offs and stock-out risk.

Align financial & commercial cycle for integrated planning

Only the integration of financial aspects will really drive decision-making and enable cross-functional alignment. To integrate commercial and finance, meeting structures of all involved parties, decision-making, and reconciliation of numbers/forecasts must be aligned. Bringing together these functions is a major step for the organization that dramatically increases overall business understanding, forecast accuracy and shareholder trust in financial prognosis.

Strong S&OP/IBP to Master the VUCA World

We have detailed the most common issues in S&OP/IBP and shared our recommendations to drive overall effectiveness and boost decision-making in existing S&OP/IBP setups. When it comes to a state-of-the-art S&OP/IBP landscape, which works in the VUCA world, much more than smaller adjustments is needed.

In the new mindset, the classical S&OP including the well-known connection to IBP to drive value decisions becomes the heart of all planning processes. Companies who do not run IBP have a competitive disadvantage. On the other side, the connection towards execution gets significantly strengthened as the monthly cadence is not sufficient to cover dynamic changes caused by the VUCA world. An S&OE (Sales & Operational Execution) process on a weekly basis will act as an intermediate process to link tactical planning to operations.

On top of this framework, further building blocks can be added to adapt even better to changing requirements. From today’s perspective, we see the need for a special focus on 1) resilient S&OP and 2) green S&OP.

Within resilient S&OP, the trend is to move away from static plans where a master production schedule is created monthly, highlighting major changes to the old plan. Resilience is in many cases achieved through a Demand-Driven Operating Model, where for example decoupling points are set in an intelligent way, so that supply can react much quicker to demand changes.

Regarding green S&OP we believe that sustainable topics must be embedded in the core cycles for decision-making and not handled in separate forums. As S&OP is the heart of a company’s decision-making process, sustainable topics that require decisions must be included.

A Roadmap for Improvement

This article describes challenges found in S&OP/IBP and gave some recommendations. Furthermore, we have outlined our perspective towards the overall S&OP/IBP landscape in the VUCA world.

In our next article, we describe how to design a forward-looking, cross-functional and integrated S&OP process from scratch. The aspect of financial integration (IBP) will follow in another article, as well as our S&OP perspective on scenario planning, resilience, Green S&OP, S&OE as a weekly process.