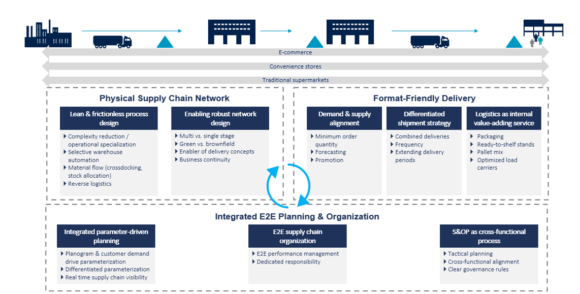

Disruptive trends are demanding a redesign of grocery retail supply chains. Besides format-friendly delivery and the physical supply chain network, an end-to-end operating model is the way forward to shape the retail supply chain of the future.

In the concluding part of our blog series, we want to discuss the third and last guiding principle of the retail supply chain of the future: installing an end-to-end (E2E) supply chain operating model as a critical prerequisite for implementing the key improvement levers we described in the previous posts.

Exhibit 1: Guiding principles for SC grocery retail strategy

As decisions in one part of the supply chain frequently have impact on other parts, we need to look at the supply chain truly end-to-end (i.e., from suppliers via warehousing and transport down to the point of sales). This doesn’t necessarily mean to put all responsibility in one hand. It is more about facilitating the collaboration on key topics across all stakeholders along the supply chain and plan the entire supply chain in an integrated way (utilizing adequate planning tools).

To achieve this goal, we see the need to implement three pillars of end-to-end supply chain management:

1. E2E accountability for information and material flows (supplier – POS)

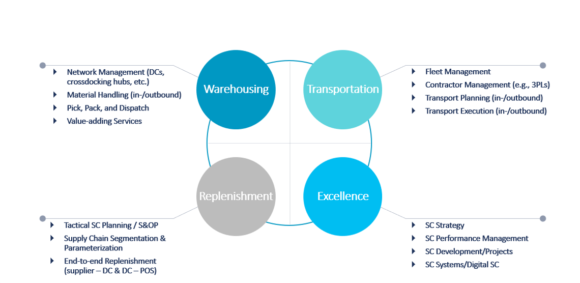

The key prerequisite for driving an optimized end-to-end supply chain is to have single accountability for the information and material flow along the supply chain. A holistic supply chain function should combine classical logistics topics (namely warehousing and transportation) with the accountability for E2E replenishment decisions – from suppliers via warehouses/cross-docks towards the points of sales. Mutually agreed service level agreements (SLAs) provide a clear framework for transparent and close collaboration with other stakeholders along the supply chain.

Exhibit 2: Holistic supply chain function

In addition, we see the need to also implement responsibility for more excellence- and development-related tasks like for instance E2E performance management, project management, and any supply chain intelligence topics. In today’s volatile times, modern supply chains need to constantly adapt and progress. This can’t be managed just besides managing the daily supply chain execution; a dedicated responsibility should be implemented.

2. Cross-functional collaboration and decision processes

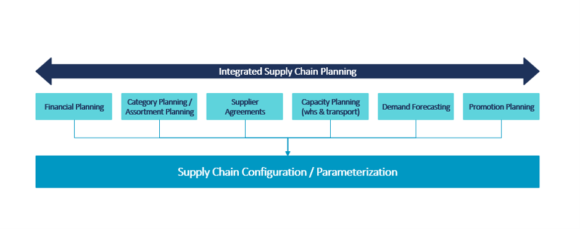

The second pillar of end-to-end SCM is the implementation of cross-functional alignment and decision processes, which mainly covers two aspects. The first aspect is the introduction of a Supply Chain Control Tower function, which focuses on monitoring operative supply chain processes with the overall aim to mitigate upcoming risks, avoid disruptions, and secure replenishment. The second aspect refers to the tactical planning horizon: Being an established concept for producing industries, Sales & Operations Planning (S&OP) as tactical, cross-functional decision process is not very common in retail yet. Nevertheless, there is the strong need to put the focus on tactical planning and cross-functional alignment beyond solely managing SC execution. Topics like new product launches, supplier shortages, capacity bottlenecks, expected demand peaks, promotions, etc. require a regular cross-functional alignment between all stakeholders along the supply chain, mainly sourcing/procurement, SCM (incl. warehousing, transportation, replenishment), and sales channels. While procurement should be responsible for all supplier-focused subjects, SCM needs to be involved when supply chain related topics are discussed (e.g., packaging, transport discounts, delivery agreements). The same holds true for the collaboration with sales when it comes to market- and client-related topics, e.g., promotion planning or new client delivery models. S&OP ensures a structured and regular alignment following clear governance rules and facilitating end-to-end optimized decisions.

Exhibit 3: Integrated supply chain planning

3. Integrated E2E parameterization

Today’s supply chains need to be supported by modern software packages (like SAP CAR, o9, etc.), utilizing planning parameters as fuel for the right decisions. Planning parameters determine the level of inventories, replenishment frequencies, and order sizes – to just name a few of them. In order to always ensure adequately (i.e., according to current business circumstances) set parameters, a regular parameter review and update process is key. Modern supply chains utilize segmentation approaches as well as AI/ML techniques to ensure a differentiated parameterization to best match end-to-end replenishment with actual demand and supply chain capabilities. For that, having full transparency of demand across all sales channels is key. Parameterization should be driven from market side with planograms and demand patterns forming the basis to manage replenishments.

With the implementation of these three pillars, the important foundation for better collaboration along the supply chain and client-focused improvements is set.

Summary

Over the course of this blog series, we highlighted the need for change in retail supply chains: Business circumstances for grocery retailers have been changing dramatically and supply chains need to keep track supporting game-changing (sometimes even disruptive) business decisions.

We guided you through a set of guiding principles including format-friendly delivery, the physical network structure, and the need for an end-to-end supply chain operating model. The proposed improvements in these areas bring significant benefits: most importantly, customer service will improve significantly, mainly with respect to product availability and freshness. In addition, supply chain resilience will be enhanced by setting up a robust supply chain network and processes. And finally, this comes with overall lower supply chain cost.

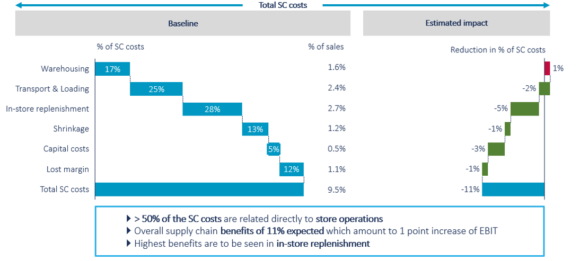

Exhibit 4: Supply chain costs

Depending on the starting point in terms of supply chain maturity, we typically see improvements in overall supply chain cost between 7 and 15% of revenue (on average 11%) with the biggest savings potential in store operations enabled by improved supply chain processes. This might slightly increase efforts and cost in warehousing and/or transportation what quickly pays-off by the achieved savings on store-side. Lower inventory costs (~3%) as well as less shrinkage (~1%) and reduced lost margin (~1%) achieved by optimized replenishment (yielding to better on-shelf availability and best-fitting inventory coverage) are further contributors to the overall improvement potential.

This post is the sixth part of our blog series on how to build a future-proof grocery retail supply chain. Further parts of the series:

Part 1: How to Shape Your Future Supply Chain – Omnichannel in Full-Assortment Grocery Retail

Part 2: The Three Principles of Future-Proof Grocery Retail Supply Chains

Part 3: Grocery Retail: How to Align the Supply Chain towards Market Demands

Part 4: Boosting Sales Performance in Grocery Retail Supply Chains

Part 5: Setting the Table: Designing a Supply Chain Network in Grocery Retail