Over the past few years, CAMELOT has been monitoring pharma distribution in different regions of the world, especially North- and Latin America, Asia, Africa, and Russia. This blog post summarizes the key take-aways and provides a global view on trends and perspectives in pharma distribution.

One of the most important objectives of pharmaceutical companies is to ensure safe and reliable distribution of drugs to their patients. However, companies are confronted with very diverse maturity levels of the pharmaceutical markets, different growth potential depending on the geographical region, varying logistics infrastructures as well as political and tax regulations. Therefore, different region-specific approaches in pharmaceutical distribution are necessary.

Market opportunities and challenges

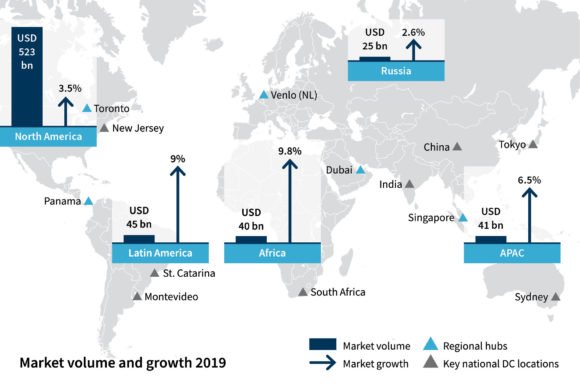

The global revenue of pharmaceuticals has seen a steady increase every single year since 2001, accounting for USD 1.25 tn today. Moreover, a further increase of approximately 4.6% annually is expected from 2020-2027. [1] Today, North America, with total sales amounting to approximately USD 523 bn 2019 [2] is the largest single pharma market. However, while mature markets like the US and Europe are saturated with growth mainly depending on new products and services, emerging markets such as Latin America, Asia, and Africa, still offer a high potential for growth with existing portfolios. They are therefore closely monitored by pharma companies.

Pharma market: volume and growth 2019

Despite these promising developments, pharma distribution is still a major challenge, involving diverse region-specific market risks and issues. The US market faces high pricing of pharmaceuticals due to missing governmental price controls and limited access to lower priced medicine from abroad. Regions such as Latin America, Africa and Russia still struggle with geopolitical risks, corruption, and illicit medicine. The African continent, moreover, must cope with security issues, unstable political situations and approx. 30% of counterfeit [3] products. Although these challenges are rather obvious, they indicate that a detailed analysis is inevitable for pharmaceutical companies before entering those markets.

Logistical requirements and network distribution structures

Alongside general market-specific challenges, additional aspects regarding the successful distribution of drugs to the end customers need to be carefully considered. One of the most important issues is the underlying and often fragmented distribution infrastructure, including the availability of sea- and airports, street networks, and suitable warehouses. This is especially important when considering the long distances that need to be covered even in domestic transportation e.g. in the US, China or Russia. Therefore, advanced distribution networks are a prerequisite to offer next-day delivery, which is a common practice in pharmaceutical business.

When it comes to the underlying logistical infrastructure and the distribution networks, there are significant differences. While in mature markets like North America or parts of the APAC regions including Japan and Australia, the general distribution infrastructure is highly advanced, in other regions like Africa and APAC including India and Indonesia or even Russia, this is different. Fragmented streets, dilapidated airports or poor warehouse conditions are still present, which often hinders the efficient, safe and timely distribution of pharmaceuticals. Since the main infrastructure in such regions is centered around major cities, this issue is exacerbated in rural areas.

The maturity of the North American infrastructure is also reflected in the existing network distribution structures. The market is clearly dominated by three major wholesale distributors – McKesson, Cardinal Health and AmerisourceBergen – which all have immense distribution networks with dozens of warehouses and specialty facilities scattered throughout the country to accommodate nearly every pharmaceutical distribution need and to facilitate next-day delivery for the majority of their customers. From a geographical perspective, the most important pharmaceutical distribution hub is New Jersey.

Outside most of North America and Europe, there are several regions that face major issues in their network distribution structures. For instance, the distribution in Africa is often managed by distributors and several subcontractors rather than logistics service providers. As such, pharma companies lose transparency of the processes and mechanisms in the market. Thus, when distributing into Africa, the preference should be to limit the dependency on national or sub-regional distributors. Today, it is often feasible to distribute via regional hubs in South Africa and Dubai making use as well of road transportation for further inland distribution as this has become more viable and secure in recent years.

In contrast to Africa, the distribution networks in Latin America are at least well developed around urbanized centers. However, coverage of rural regions remains a challenge, owing to large distances between different centers and difficult topologies. Factoring in the often volatile political situations, we have observed specialized national or local solutions and only limited capabilities and regional networks in Latin America. Thus, it is no surprise that the typical pharma logistics setup requires a local distribution center in almost each individual country combined with higher local inventory levels. Many pharma companies typically distribute their products directly from production to the local stock locations in the country, which leads to a high share of airfreight. Offering many flight connections and stable climate, Panama has gained a lot of traction over the past years as regional hub, and even Montevideo is experiencing growing popularity due to constraints and restrictions in Brazil.

Like in Africa, the distribution in Russia and large parts of Asia is strongly dependent on national and regional distributors, which compared to logistics service providers, are responsible not only for storage and transport but also for the commercialization of pharmaceuticals. In Russia, for instance, Puls, Protek and Katren are the largest distributors, which account for more than 50% of the total Russian market. As a consequence, most of the Russian distributors own pharmacy chains or even have their own local production, which is likely to strengthen the vertical integration in future.

Recent developments and outlook

The future of pharmaceutical logistics is expected to remain dynamic, challenging and loaded with procedural, technological, and operational innovations as logistics processes and structures adapt to growth and increased complexity. The COVID-19 pandemic, for instance, has shown how much the globalized world depends on the supply especially from China and how vulnerable the pharmaceutical supply chains still are. The shutdown of pharmaceutical manufacturing combined with the unavailability of transport capacity, has not only resulted in major disruptions in medical supplies like masks or surgical gloves, but also of basic medicine like headache remedy. Business strategies around risk mitigation and improved supply chain resilience like “near-shoring”, “dual sourcing” and “right sizing” of inventory levels are now pursued where feasible and justifiable. Moving forward, it will be key to reduce the complexity as well as increase the flexibility and resilience of the global production and distribution set-up, enhancing the view so far mostly focused on cost and service levels. With those business strategies in mind, pharma companies with digital twins of their production and distribution networks have the advantage of being able to identify and develop suitable alternatives. This can be achieved using agile technical solutions that support the need for continuous analytics of the respective options and their impact even at a tactical level. We strongly believe that such business strategies are a game changer for the pharma industry and that digital twins will be essential in mastering the global production and distribution challenges, breaking down the barrier between network design and supply chain planning.

[1] Pharmaceutical Manufacturing Market Size Report, 2020-2027 (grandviewresearch.com)

[2] Top 10 pharmaceutical markets – Revenues 2015 – 2019 | Statista

[3] Africa Renewal May 2013 – Counterfeit drugs raise Africa’s temperature; Pharm Pharmacol Int. J. 2015, 2(2): 00016