In our last blog post, we have explored the nature of biotech value chains and why biotechs need aninnovative value chain model to improve efficiency, sustainability and resilience – which is of particular importance in COVID-19 times.

We highlighted the 10 capabilities biotech companies need to exploit the full potential of their value chains. Today, we are going to take a closer look at these 10 capabilities.

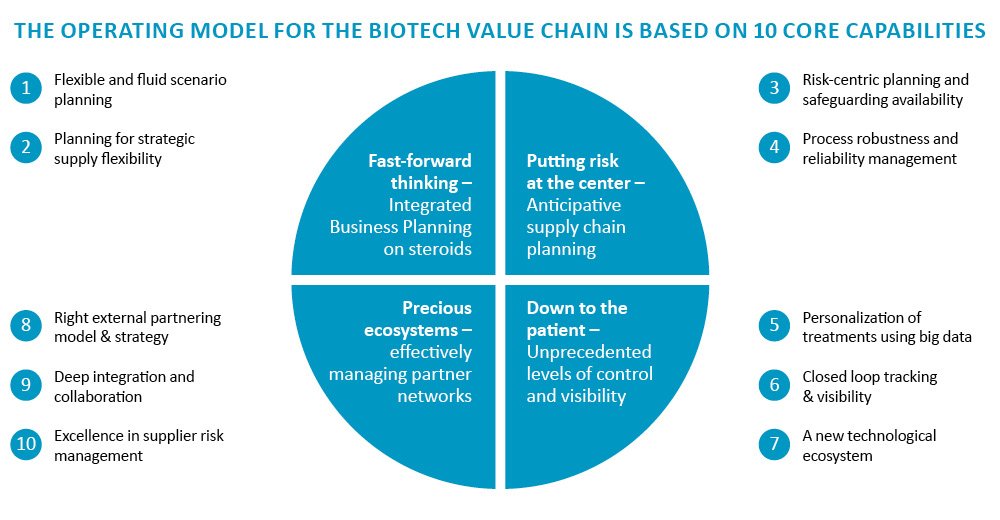

The 10 core capabilities of biotech value chains

As outlined in our last post, the following 10 capabilities split across four dimensions are critical for biotech value chains:

Fig. 1: Core value chain capabilities specifically for biotech players

Fig. 1: Core value chain capabilities specifically for biotech players

In the following, we are going to explore each of these capabilities in more detail.

Fast forward thinking – Integrated Business Planning on steroids

Many pharma companies have implemented Integrated Business Planning (IBP) to align demand and supply, as well as to allocate company resources to maximize profitability and growth. However, the biotech world is not linear and incremental. It is complex, non-trending, and full of single strategic choices/bets which can turn around a company’s value in the blink of an eye. Examples include decisions to close a commercialization contract for a self-developed drug in a particular territory, as opposed to marketing the drug independently. Thus, two capabilities become vital for Integrated Business Planning in biotech:

Flexible and fluid scenario planning: Pharmaceutical companies require a dynamic evaluation of different launch scenarios,driven amongst others by considerations about regulation, pricing and reimbursement, and tax. However, biotech scenarios are becoming more complex for several reasons: development cycles become shorter and more volatile due to rapid and groundbreaking advances in new scientific areas; outcomes of clinical trials often depend on small patient populations and may require very granular planning; treatments can hit the fast-track approval process, meaning that companies need to plan earlier on how to climb up the competitive treatment algorithm ladder with the goal of first-line treatment indication; future label extensions need to be planned well in advance. Thus, biotech companies need highly flexible and fluid scenario planning approaches, which continuously identify assumption changes and plan for multiple paths into the future, each with transparency into lifetime value, total cost, and probability of success. As one example,we have worked with a biotech company to design its global supply chain organization. This organizational design included setting up the governance for a cross-functional launch planning to integrate the clinical, business, and operations perspectives seamlessly and to allow decision-making based on integrated business scenarios.

Planning for strategic supply flexibility: In addition to the demand-side scenario planning described above, biotech companies need a rigorous approach for planning strategic preparedness and flexibility on the supply/capacity side. Strategic supply flexibility is key to keeping open a range of strategic options for marketing a pipeline or keeping a stronger position in negotiations on manufacturing or commercialization partnerships. Leading companies not only meticulously keep track of the decision path and critical milestones from research to commercialization, e.g., when to start contracting in a CDMO for Phase III clinical supply while still having all the options to build in-house capacity, they also investigate investments in their own capacity. This takes place not only from the standpoint of readiness for launch and future profitability but also from a game-theory perspective, maximizing their strategic flexibility: Is it worth building a commercialization footprint in one part of the region in-house? How would that impact strategic options or the negotiation power as opposed to using alternative commercialization partners? Today, there is a variety of business archetypes and commercialization strategies (licensing, launching, or a hybrid approach) in the biotech industry, and the right flexibility strategy can make outsized contributions to drug lifetime value.

Putting risk at the center –Anticipative supply chain planning

Taking into account the strict regulation, the high patient impact and value at stake, more vulnerable products, and volatile, long lead time processes, biotech is exposed to a large number of value chain risks. Thus, biopharma companies need an anticipative, adaptive approach to supply chain planning that continuously screens for sources of variability and risk and effectively mitigates them, as opposed to only anchoring on productivity improvement and working capital optimization.

Risk-centric planning and safeguarding availability: For many biotech companies, the highest upside is avoiding the downside, thus avoiding risks ahead of time is a top priority. Supply network planning needs to systematically factor in supply risks from raw material availability, process instability, and output variations. In a world of long lead times, these risks need to be adequately quantified and assessed, and anticipated with different supply strategies and tactics, e.g., diversification of sources, flexible agreements, buffer lead times or inventories, or flexible in-house capacity.

Process robustness and reliability management: In line with the FDA risk-based approach, designing processes for robustness is a key prerequisite for achieving a consistent supply of safe and efficacious drugs, especially in biotech. The approach starts with building a fact-based understanding of critical quality attributes (CQA) and critical process parameters(CPP), how they impact process outcomes (quality, compliance, cost-effectiveness), what their tolerance levels are, and how to best control them. Process performance then needs to be monitored across clinical supply, scale-up, and the commercial manufacturing stage. The leading companies use data and analytics to screen in real-time for deviation patterns of critical process parameters and use the information swiftly, not only in their manufacturing and quality control systems but also in supply chain planning or feeding the end-to-end control tower. Such process data can be invaluable for understanding better expected outputs, probabilities of disruptions, and critical risks to supply, all of which can help to better inform risk mitigation decisions in the short- and mid-term.

Down to the patient – Unprecedented levels of control and visibility

Biotech is not just concerned with highly effective drug substances derived from living organisms and cells. It is also focused on innovative ways of tailoring treatments to patient needs and the move to a single-patient treatment paradigm.

These personalized treatments – which are just at the beginning of their commercial use and have a considerable development pipeline – are turning the current harmaceutical value chain model upside down:

Personalization of treatments using big data: Modern biologics are increasingly using big data to tailor treatments to patients’ needs, for example, in the areas of oncology and autoimmune diseases. Using new technologies, biotech companies can better tailor the type of drug, its formulation, dosage, and the treatment process to the needs of patients, thusimproving therapeutic success and reducing the risk of side effects as well as healthcare costs. The enabling technologies range from computational modeling of tumor growth, over big data analysis of standard clinical patient records, to genomics.

Closed–loop tracking & visibility: As small irregularities can jeopardize treatment efficacy, biotech companies are not only using real-time tracking of locations, but are also monitoring temperature, orientation, humidity, shock, and handling of samples and treatments. And visibility does not stop at the level of shipments and products, as is the standard in the pharmaceutical industry. Enabled by new technology, the integration of medical information into the material flow helps to flawlessly identify shipments on patient-level and improve communication between manufacturers, specialized supply chain providers, patients, and healthcare professionals.

A new technological ecosystem:To achieve these new levels of personalization, supply chain control, and visibility, biotechs need to partner on the technology side to set up an innovative IT and systems infrastructure. This includes sensor technology for containers as the key source of information, mainly cloud-based digital visibility and analytics platforms for real-time control and action-taking guided by artificial intelligence, and connectivity layers and trusted computing appliances that safely connect material and information flow with patient information where trusted participants of the value chain require it.

Precious ecosystems –effectively managing partner networks

Biotech shows some extraordinary characteristics and requirements regarding external partner management. For instance, limited dual sourcing and supplier flexibility results in a high degree of dependence on external partners – e.g., providers of chromatography resins, lab equipment, CDMOs, or logistics providers. Also, suppliers are often in a position of strength concerning their customers, e.g., big life science groups or CDMOs with leverage as opposed to small biotech startups. Thus, the right partner strategy and management plays an essential role in enabling successful launch and commercial success. Given the special characteristics of the area, biotech companies need to excel in a couple of areas:

Right external partnering model & strategy: Biopharma is not only driving drug treatment innovation, it has also led to a multitude of innovative external partnering models, which are challenging the outsourcing paradigm of traditional pharma companies and rendering make vs. buy decisions much more complex and consequential: Should critical capacities be built in-house or outsourced to a strong technology partner? Is a strategic collaboration with an equipment manufacturer a preferable alternative to traditional (off-premises) outsourcing to a CDMO? How can the value chain be set up and operated in an asset-light way? Is it beneficial to choose a one-stop service covering clinical to commercial supply? Answering these questions in the right manner is a critical element of the strategic planning process described above.

Deep integration and collaboration: The high degree of dependency on external partners and little margin for error requires a new quality and rigor of supplier integration and collaboration, at least with the strategic suppliers of raw materials, resins, and core development and manufacturing services. System-based integration of quality management processes with suppliers (such as qualifications, non-conformance, deviations / out-of-spec, and CAPA tracking) is critical for staying involved in quality interactions early on to avoid the flow of out-of-spec and non-compliant material into the value chain. This close integration should be accompanied by a cross-functional collaboration in regular strategic supplierS&OP reviews on a monthly or quarterly level, to solve or mitigate issues in quality and supply early on and in a trustful manner.

Excellence in supplier risk management: As a significant share of quality issues and supply disruptions in biotech is related to external suppliers, biotech companies need to go several layers deeper to protect their business from supply risks. The measures required include a systematic segmentation of suppliers from a risk perspective (impact on patients and business metrics), a mapping and deep understanding of the areas of highest structural risk, as well as regular value chain risk screenings at the site of suppliers and logistics partners, conducted by a cross-functional and experienced team. The outcome will be concrete risk scenarios with associated likelihood and time needed to recover, as well as the proposal of pragmatic risk mitigation approaches to management.

Biotech – the value chain design factory

As we have pointed out, biotech is becoming the launch engine of the pharmaceutical industry. This means that launch by launch, biotech companies need to strengthen their capabilities in effective value chain strategy and design, as they move from science to commercial supply and implement the best strategies to bring their drugs to patients. What should companies do to build these capabilities and make that change happen? Based on our experience, four prerequisites are critical:

- Strengthen the role of value chain management as the critical cross-functional orchestrator of value chain strategy and design.

- Establish processes and routines early on and on a product-by-product basis to anticipate what the value chain of a new launch would be, and which design options to keep open. Key elements can be a preview and envisioning of value chain requirements as products move to the first clinical stage, followed by in-depth value chain planning when products move into clinical phase III and indications, target patient population, and the demand / delivery profile of new drugs becomes increasingly clear.

- Actively support strategic value chain planning and decision making by senior management to bridge the gap in understanding between scientific and operations mindsets.

- Strategically invest in and continuously expand the technology ecosystem for visibility, analytics, and management of material and information flow, including connection with patient data.

All of the above is a long journey and requires substantial capability building and change management. There is a lot at stake, though: Whether biotech companies effectively build a muscle for value chain strategy, design, and optimization will be essential for their health impact and business value.

What are your thoughts and challenges? Feel free to share your feedback with us! We also invite our readers from biotech companies to participate in our current executive survey on biotech value chains. We appreciate your contribution to our research!

We would like to thank Camila Mendes and Marco Gorgas for their valuable contribution to this article.