Digital transformation is currently one of the most trending buzzwords in business. But how does it change the collaboration between buyer and supplier? In a short series of articles, we will shed light on this question. This first article provides an overview of today’s supplier management and how companies conduct the most relevant processes.

Part I: Supplier Management being a driver for competitive advantage

The strategic importance of supplier management has increased since manufacturers switch their strategy from transactional relationships focused on cost efficiency, towards the creation of value from their suppliers. Practitioners largely support the direct positive impact of supplier relations on the performance of both involved companies and see that the collaboration is a driver for competitive advantage. The active management and the understanding of the relationship characteristics help managers to optimize the performance outcome of the partnership. In our latest research study “Impact of digital transformation on supplier management”, we have analzed how organizations currently manage their suppliers. Here are the main findings, which can help companies to review their own supplier management.

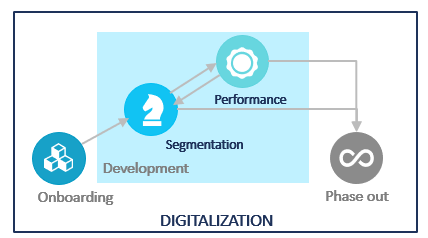

A supplier relationship typically evolves in the three main stages of onboarding, development including segmentation and performance, and the phase-out stage. The onboarding stage covers everything before the first transaction and usually starts with the awareness that there might be a feasible partner for future business (from buyer or seller side). It ends with the first business agreement between the two parties. The onboarding is followed by the development stage, which includes all activities to develop, manage and strengthen the business relationship. Depending on the economic benefit that can be derived from collaboration and the interpersonal fit between the involved parties, companies invest in the partnership and reach a higher level of commitment. The phase-out stage consists of all activities to identify and terminate non-performing suppliers. Not all suppliers necessarily reach such a strategic importance but can be terminated at any development phase.

Fig.1: Stages of Supplier Management

Supplier managers conduct a variety of processes and activities to manage a supplier relationship within the three different stages of a relationship lifecycle. Let’s take a closer look at this:

The onboarding process: starting point for a successful supplier lifecycle

Processes in the onboarding stage include the identification of potential suppliers, the supplier selection, and the actual data-based onboarding. Companies distinguish between two main initiation approaches: They either identify potential suppliers proactively or conduct an external market screening if they get triggered to find a new supplier for a specific business agreement. The proactive approach increases the number of available suppliers and helps the supplier manager to find the best suitable supplier for every product or service with sufficient ramp-up time. However, this procedure is not ideal for every market constellation. While commodity suppliers are often identified proactively due to the nature of the business, supplier managers prefer an external market screening based on specifics as soon as it comes to products which require specialized know-how and expertise.

All activities to identify, select, and onboard suppliers currently usually require a lot of manual effort from the supplier manager. Information about proactively identified suppliers needs to be maintained and updated manually in an internal supplier portfolio, and the external market screening consists of extensive internet research, visits of trade fairs, or reading through newsletters and databases. These tasks are very time consuming and can still not assure a comprehensive overview of all available suppliers.

Combining hard facts and the experiences of an organization

The development stage includes processes of performance measurement, supplier segmentation, and the execution of development activities. The performance of suppliers is measured based on a range of operational hard facts and soft facts. Hard facts include measures such as spend, reliability, or quality. Soft ones evaluate the motivation and innovation potential of the supplier. The main challenge of current performance measurement is a scattered storage of information. The supplier manager needs to consolidate all relevant information from multiple departments and operating systems before he gets a full overview of the supplier performance.

The strategic relevance of supplier segmentation to select the right partners for development activities is widely accepted in theory and practice. However, the interviewed companies show little interest in the segmentation process and follow somewhat unstructured and intuitive approaches. Development activities are conducted to either counteract decreasing supplier performance or to improve existing relationships to gain a competitive advantage. The activities should be conducted on an equal power level and aim at achieving improved performance for both parties.

The supplier phase-out stage is mainly based either on lost business due to a sourcing event or negative performance results. The ending stage is mainly master data driven as sourcing managers usually consider to restart business at a later stage. The phase-out stage usually doesn’t gain a lot of attention in practice, and a standardized process to terminate a relationship has often not been defined.

Identifying the right business intensity and collaboration with each supplier

The results indicate that supplier managers currently spend a significant stake of their time on administrative tasks and the collection of relevant information to make profound decisions. The remaining time is used to conduct directly value-adding processes such as the conduction of joint development activities.

However, the unstructured segmentation processes show that supplier managers neglect the long-term effect of those strategic processes. Identifying and distinguishing between suppliers with development potential and the supplier relationships that should be decreased or terminated help companies bundle their resources on the most promising suppliers for future business.

In our next article will deep dive into the latest developments in supplier management driven by the digital revolution. So stay tuned!

Part II: Digital Transformation – What’s next for supplier management II

I would like to thank Wolf Göhler and Carlotta Schüßler for their contribution to this article.